Commentary

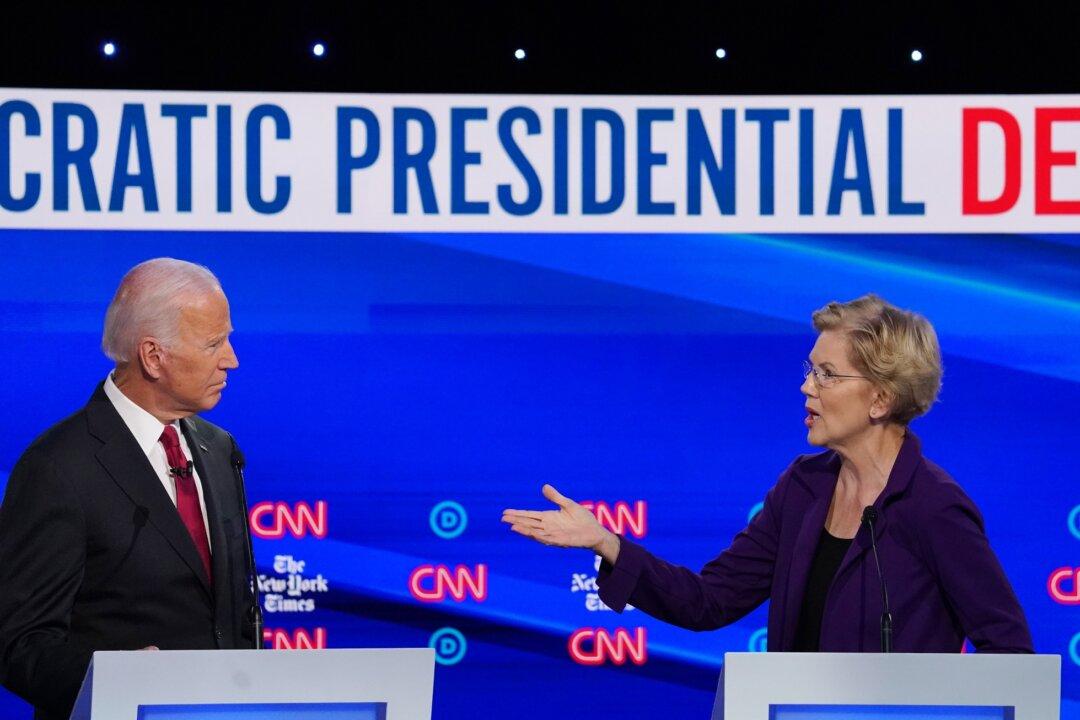

On Oct. 15, 12 pugnacious presidential candidates for the Democratic Party held their fourth debate. It was filled with economic promises that don’t add up.

On Oct. 15, 12 pugnacious presidential candidates for the Democratic Party held their fourth debate. It was filled with economic promises that don’t add up.