Commentary

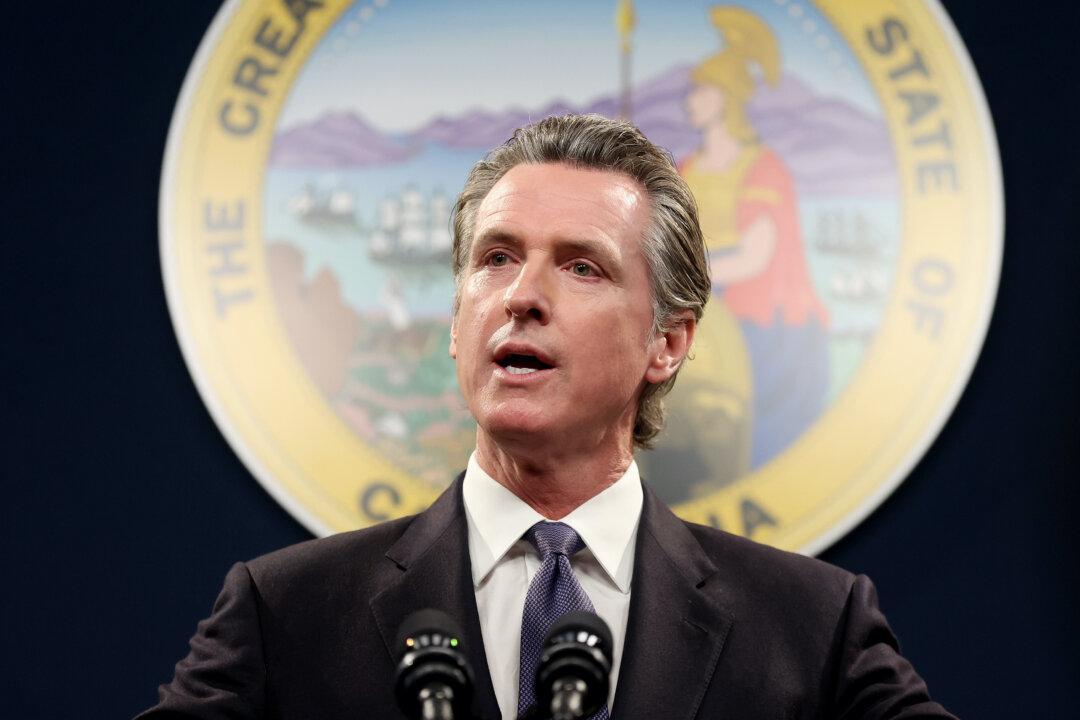

You would think Gov. Gavin Newsom would be happy with higher gas prices at the pump, and the ensuing high oil company profits. The hits to consumers encourage people to buy the electric cars his 2020 executive order mandates for all new-vehicle sales by 2035. The order even explained at the time, “Clear policies such as the Governor’s Executive Order help provide market signals to investors and can mobilize private capital.”