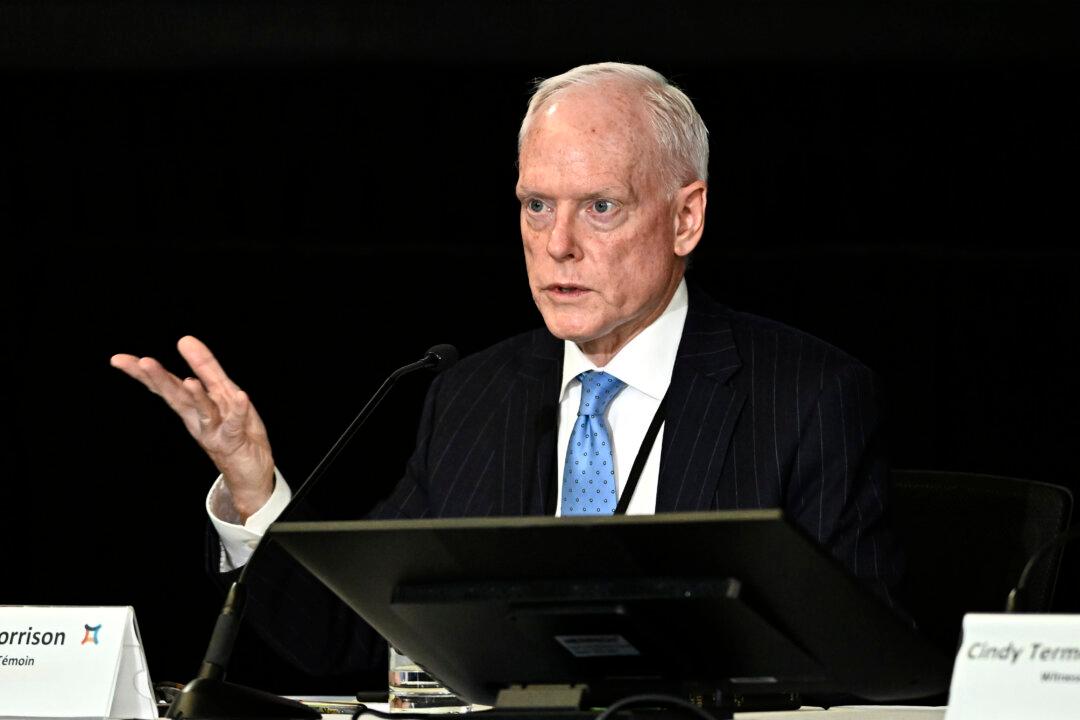

Bank of Canada Governor Tiff Macklem told MPs on Feb. 16 that if the Liberal government increases spending in some areas it could hurt his current forceful approach to rein in inflation.

Testifying before the House of Commons finance committee, Macklem took questions about the impact of government spending on his inflation fighting mission as the next budget approaches.