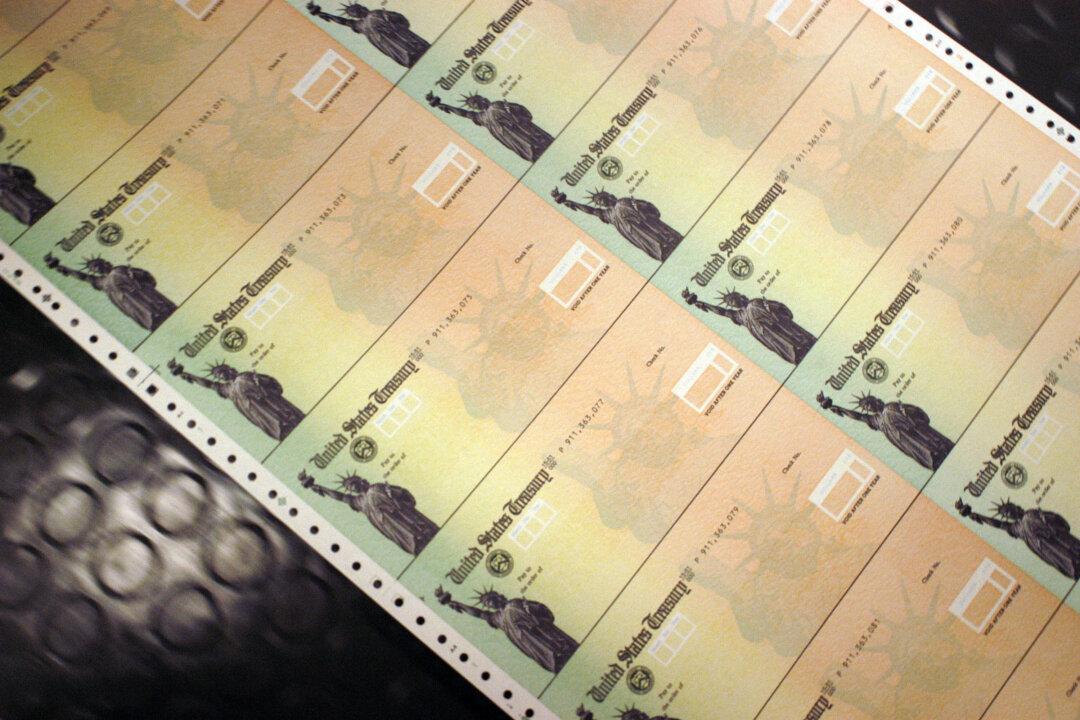

Social Security recipients started receiving a significant increase in their benefits this week amid decades-high inflation that sparked an 8.7 percent cost-of-living adjustment last year.

The first payments with the adjustment for 2023 were already disbursed for many Social Security recipients, with more coming throughout the month.