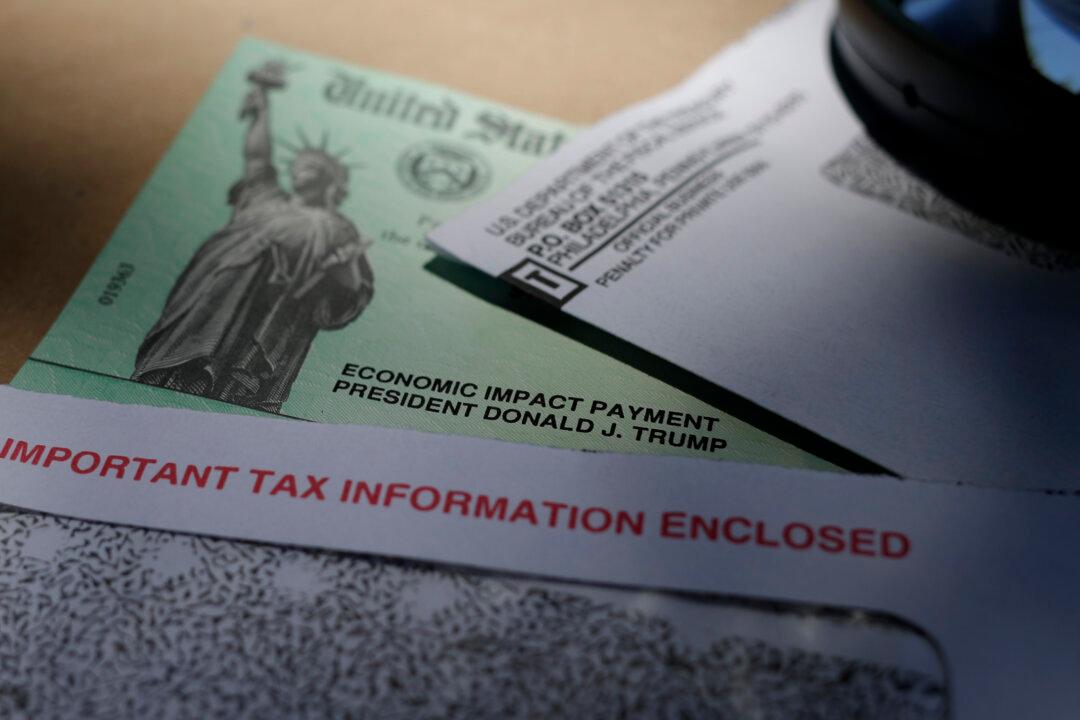

A Republican lawmaker in Missouri has introduced state-level legislation to exempt federal stimulus checks—or economic impact payments—from state income tax.

Cody Smith, who chairs the Missouri House Budget Committee, sponsored the bill (pdf), which excludes economic impact payments from a Missouri taxpayer’s adjusted gross income, effectively exempting them from state taxes.