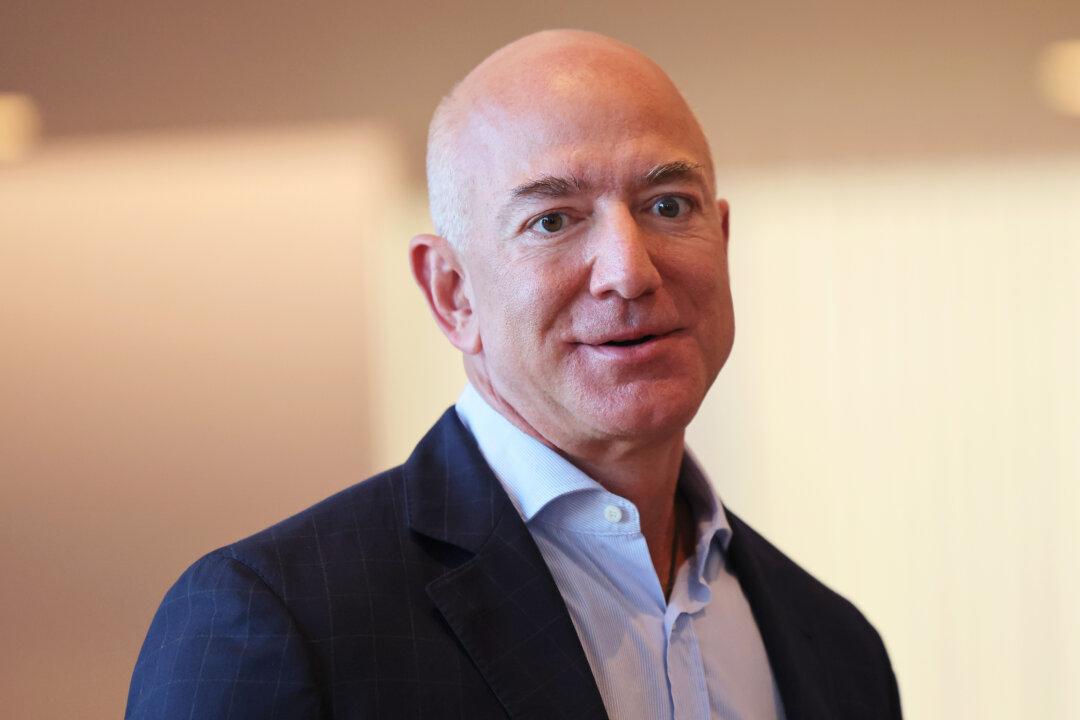

Billionaire Jeff Bezos and the White House are engaging in a war of words over inflation and tax policy.

After President Joe Biden claimed on Twitter that making large corporations “pay their fair share” can lower inflation, Bezos fired back, stating that the federal government’s new Disinformation Board ”should review this tweet” and perhaps establish “a new Non Sequitur Board.”