Cargo volumes at the Port of Los Angeles broke another record in March as the docks processed nearly 1 million containers.

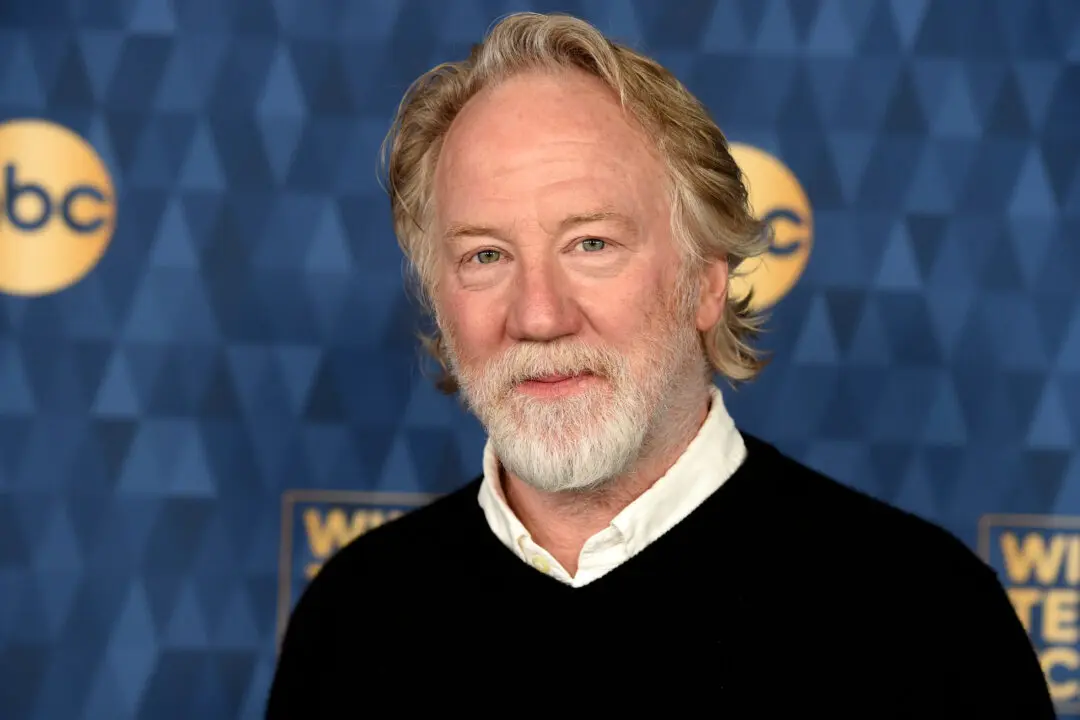

“This turned out to be the third-best month overall in the port’s history,” the port’s Executive Director Gene Seroka said at a press conference April 13. “We started out here in 2022 with three consecutive record months, and our best first quarter ever, eclipsing the previous records set just last year by 3 and a half percent.”