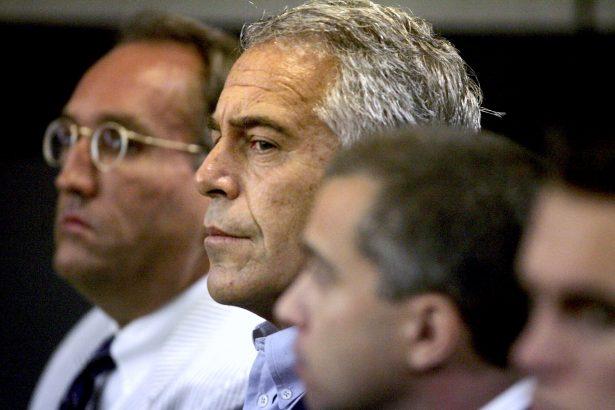

JPMorgan Chase knew about Jeffrey Epstein’s sex trafficking accusations for years before dropping him, according to new legal filings.

The lawsuit alleges that the bank knew about the accusations against the now-deceased convicted sex offender and financier—namely, paying to have underage girls and young women brought to his home since 2006.