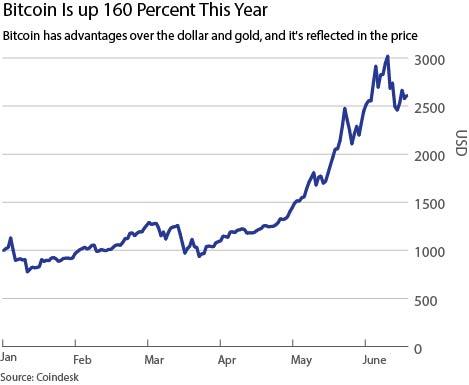

James Rickards, author of “The Road to Ruin,” has successfully predicted Federal Reserve (Fed) policy in the past. In this interview with The Epoch Times, he explains why the recent tightening could lead to a recession and why he recommends gold as a “crisis hedge.” He also explains why he thinks bitoin is in a bubble.

The Epoch Times: Why did the Federal Reserve (Fed) hike rates last week, and what will its policy look like in the future?

James Rickards: They’re trying to prepare for the next recession. They’re not predicting a recession, they never do, but they know a recession will come sooner rather than later. This expansion is 96 months old. It’s one of the longest expansions in U.S. history. It’s also the weakest expansion in U.S. history. A lot of people say, “What expansion? Feels like a depression to me.”

I think it is a depression defined as depressed growth, but we’re not in a technical recession and haven’t been since June 2009. So it’s been an eight-year expansion at this point, but it won’t fare well, and the Fed knows that. When the U.S. economy goes into recession, you have to cut interest rates about 3 percent to get the United States out of that recession.

Well, how do you cut interest rates by 3 percent when you’re only at 1 percent? The answer is, you can’t. You’ve got to get them up to 3 percent to cut them back down, maybe to zero, to get out of the next recession. So that explains why the Fed is raising interest rates. That’s the fourth rate hike getting them up to 1 percent. They would like to keep going; they would like to get them up to 3, 3.5 percent by 2019.

My estimate is that they’re not going to get there. The recession will come first. In fact, they will probably cause the recession that they’re preparing to cure. So let’s just say we get interest rates to 1 percent and now you go into recession. We can cut them back down to zero. Well, now what do you do? You do a new round of quantitative easing (QE).

The problem is that the Fed’s balance sheet is so bloated at $4.5 trillion. How much more can you do—$5 trillion, $5.5 trillion, $6 trillion—before you cause a loss of confidence in the dollar?

There are a lot of smart people who think that there’s no limit on how much money you can print. “Just print money. What’s the problem?” I disagree. I think there’s an invisible boundary. The Fed won’t talk about it. No one knows what it is. But you don’t want to find out the hard way.

The Epoch Times: What about balance sheet reduction, reversing the QE that you are talking about?