The Internal Revenue Service (IRS), in an update, said that people who are incarcerated do not qualify for pandemic stimulus payments.

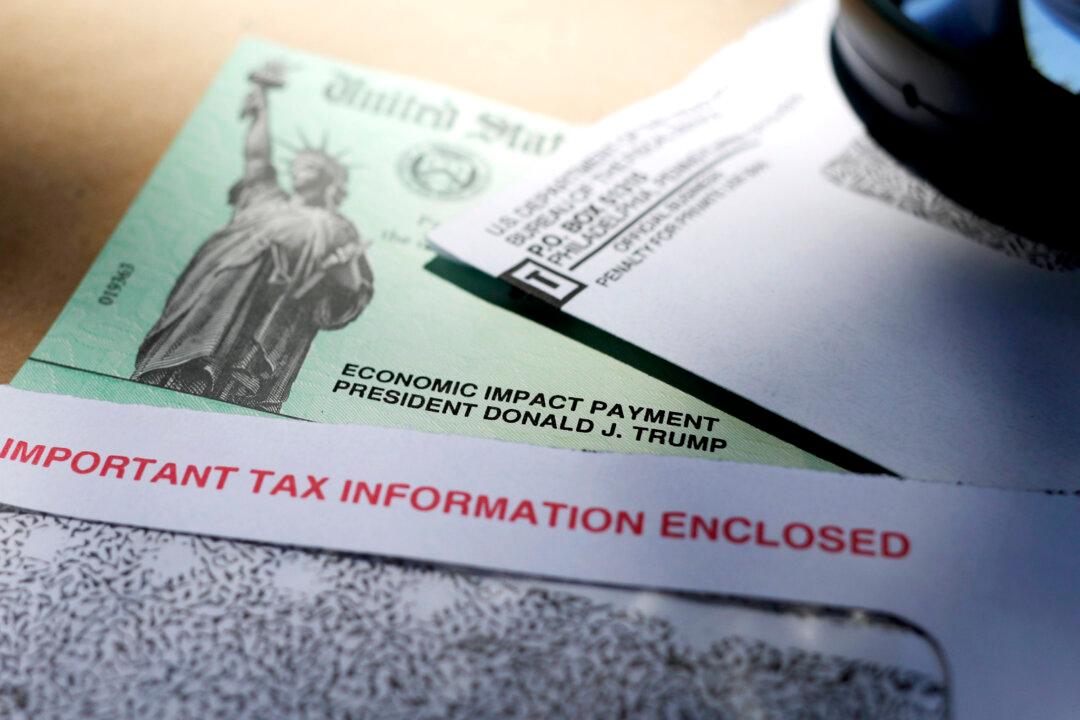

Tens of millions of payments of up to $1,200 were doled out to Americans last month after President Donald Trump signed a $2.2 trillion stimulus legislation. It was approved after numerous businesses and companies were forced to shutter to curb the spread of the CCP (Chinese Communist Party) virus.