Commentary

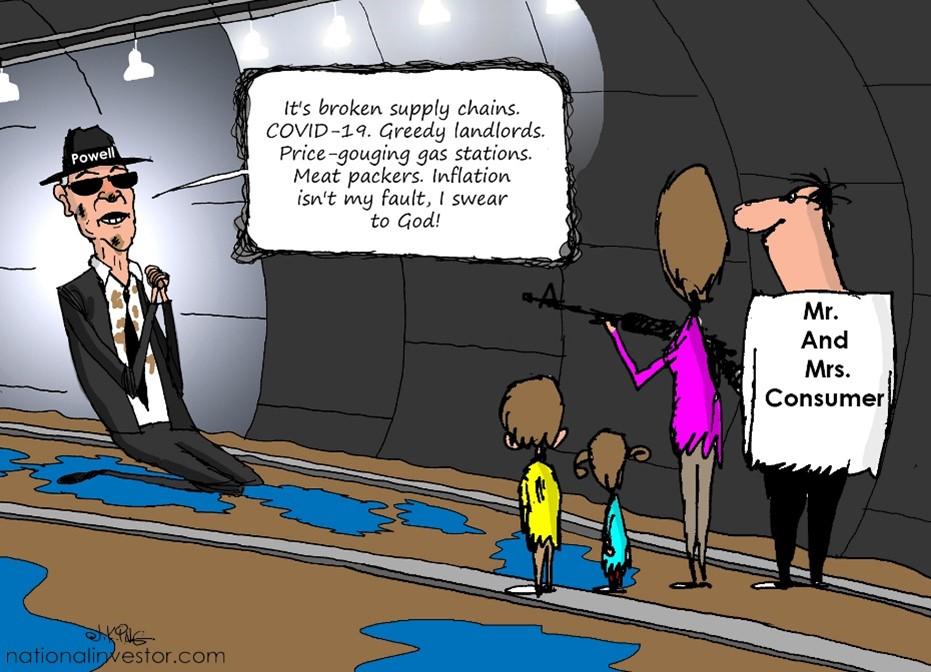

Though he has—at last—recently acknowledged that high inflation isn’t quite so “transitory” after all, Federal Reserve Chairman Jerome Powell nonetheless still blames pretty much everybody but himself for the most rapid rate of producer and consumer price increases in 40 years. As I have quipped often, he has become adept at deflecting blame for these high prices HE is the proximate cause of onto any real or perceived bogey man.