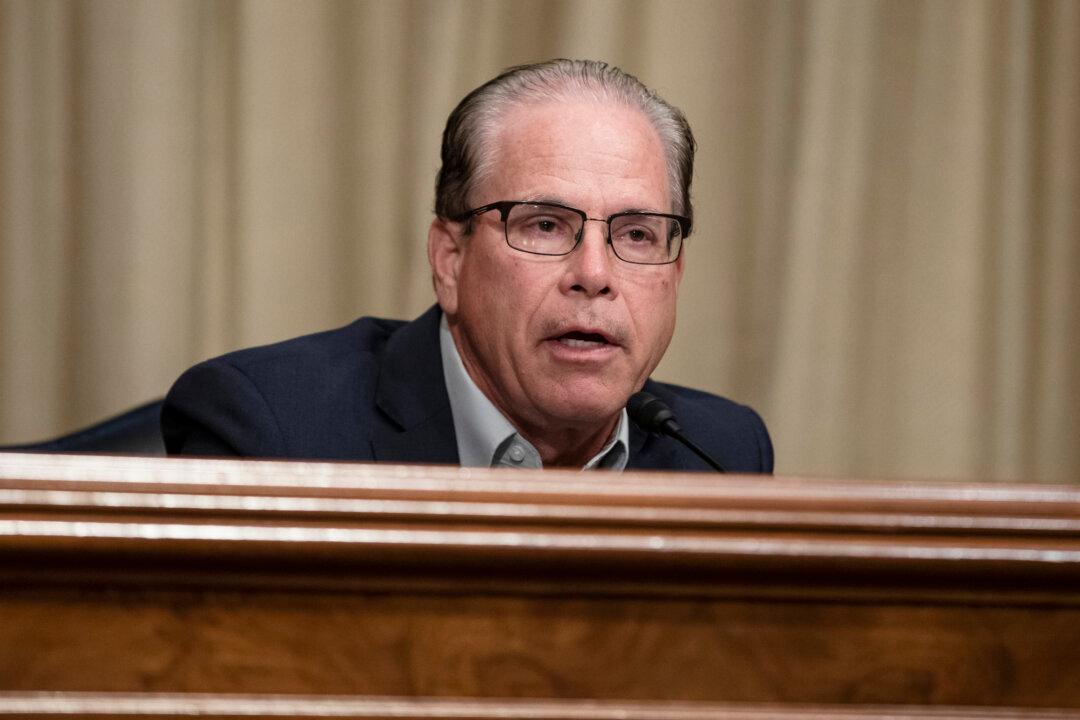

President Joe Biden’s 2024 budget proposal assumes that government income will be 19.6 percent of the country’s gross domestic product (GDP), a figure Sen. Mike Braun (R-Ind.) found hard to believe, saying the country has never generated more than 17.5 percent over 50 years and suggesting the administration was “being dishonest with the American public.”

Shalanda D. Young, director of the White House Office of Management and Budget, brought up the income projection during testimony before the Senate Committee on the Budget on March 15.