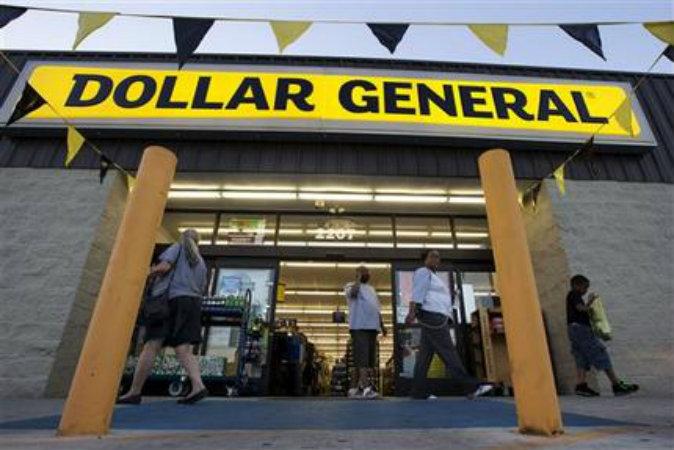

Dollar stores are seeing an increased number of customers looking to stretch their budgets amid soaring inflation, even as the cost of living is taking its toll on other retailers, according to new data.

The latest data released by foot traffic analytics firm Placer.ai shows that visits to dollar stores owned by Dollar General Corp., Dollar Tree Inc. and its subsidiary Family Dollar, and Five Below Inc. were up 13.2 percent between the first and second quarters of 2022.