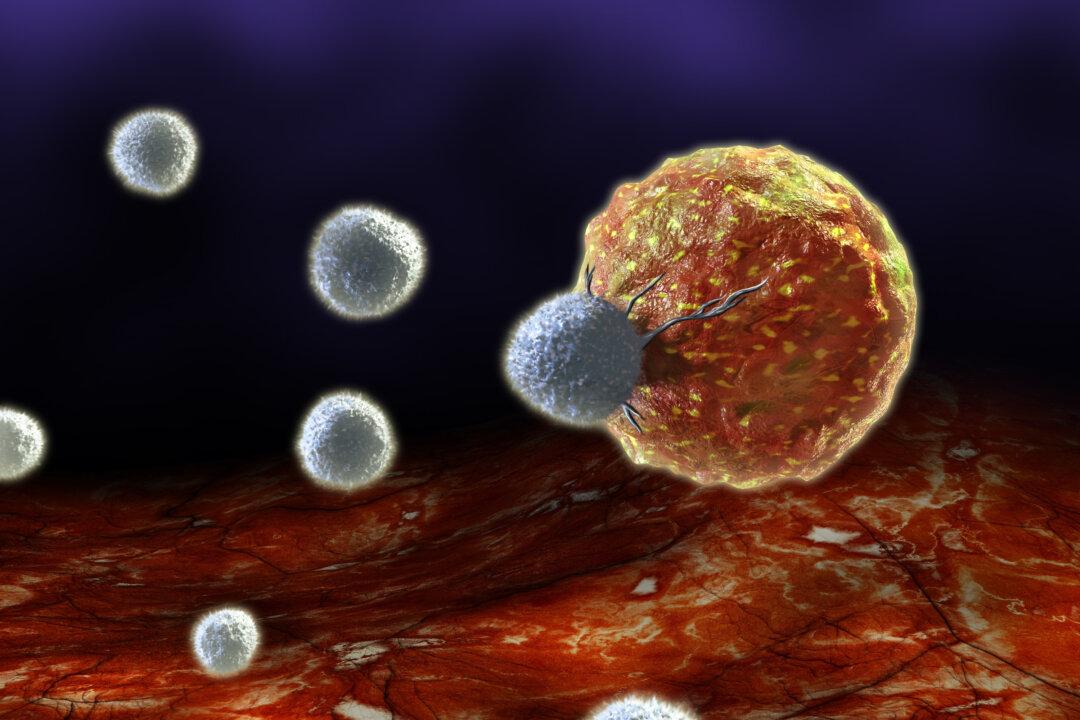

Cancer is the second leading cause of death in the United States, right on the heels of heart disease.

In developed countries, the general consensus is that if you do not die of heart disease, then the next likely event is cancer.

In developed countries, the general consensus is that if you do not die of heart disease, then the next likely event is cancer.