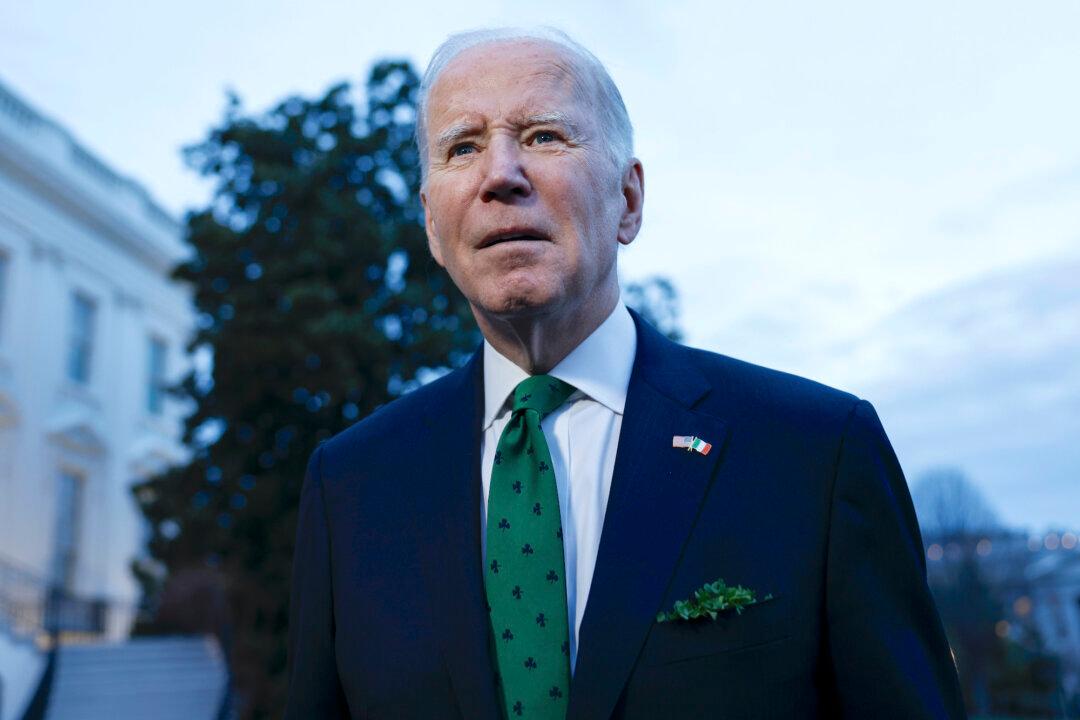

The House of Representatives on Thursday failed to override President Joe Biden’s first veto of his presidency, which was related to a Biden administration rule on environmental, social, and governance (ESG) investment.

The House vote of 219–200 in favor of overriding Biden’s veto fell short of the two-thirds majority threshold required. All Republicans who were present voted in favor of overriding the veto. Rep. Jared Golden (D-Maine) was the lone Democrat who joined them in the vote.