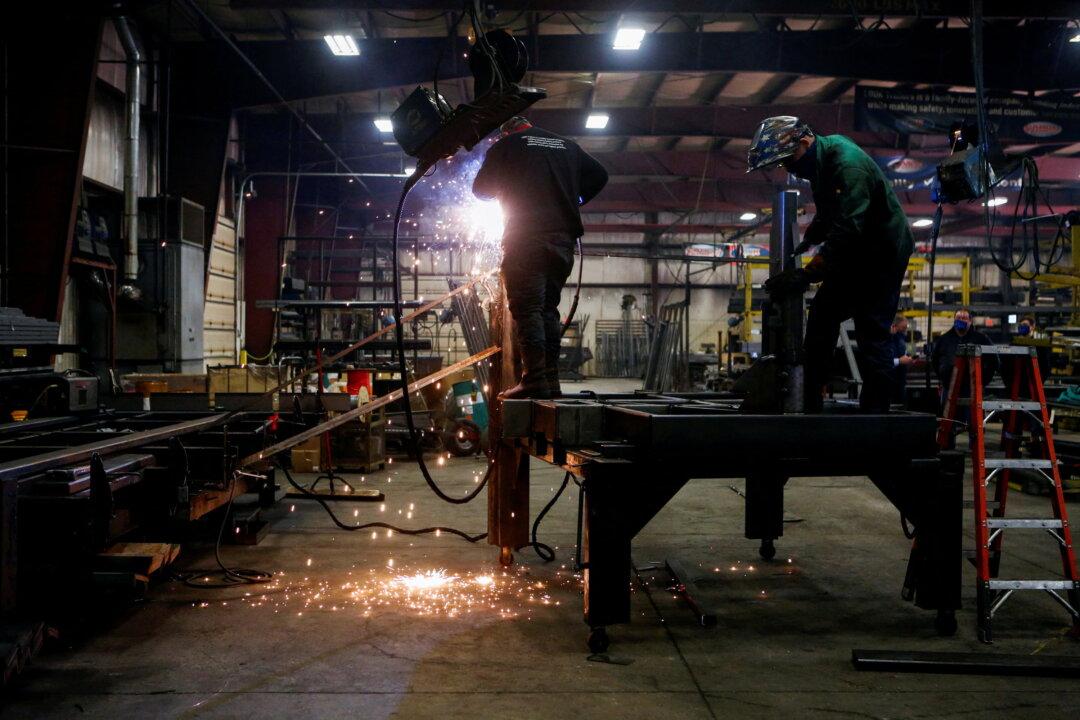

U.S. manufacturing activity fell in June, but more than expected, as new orders contracted for the first time in two years, according to a survey from the Institute for Supply Management (ISM).

ISM’s manufacturing figures dropped to 53.0 in June from 56.1 in May, the weakest results since June 2020, but the ISM index is well above the 43.1 level that would signal a recession.