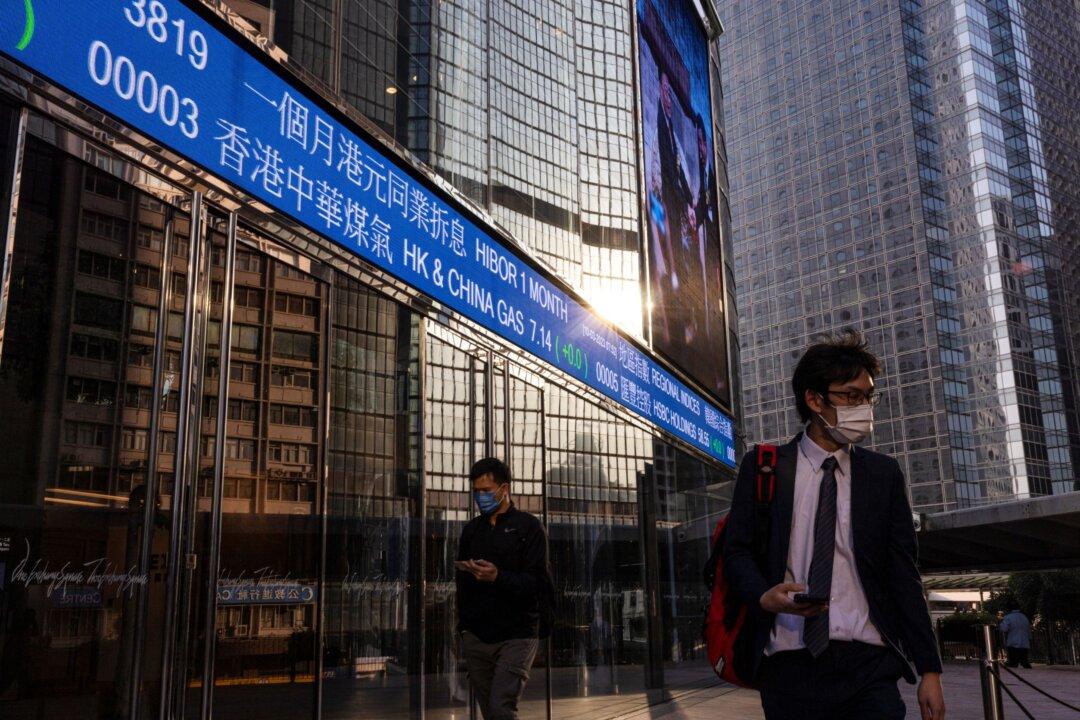

BEIJING—Global stock markets and Wall Street futures fell Friday ahead of a U.S. job market update amid unease about possible further interest rate hikes.

Markets in London, Shanghai, Frankfurt, and Tokyo declined. Oil prices were lower.

BEIJING—Global stock markets and Wall Street futures fell Friday ahead of a U.S. job market update amid unease about possible further interest rate hikes.

Markets in London, Shanghai, Frankfurt, and Tokyo declined. Oil prices were lower.