Focus

QE

LATEST

What Really Happens When the Fed Hikes Rates

It’s not as easy as pushing a button.

|

America Invented QE, but China Has Now Confirmed It Will Use the European Version

According to the newest leaks, however, China will use the European approach to take credit risk out of the market.

|

Bank of China Pushes the Stock Market Booster Again

Another week, another effort by the Chinese authorities to boost the economy. This time the People’s Bank of China (PBOC) lowered its benchmark interest rate by 0.25 percent to 5.10 percent.

|

Is It Really That Bad? The Truth Behind China’s QE Talk

The signs are increasing China will soon engage in its own form of quantitative easing, in what could be seen as a sign of panic.

|

China QE Could Be About More Than Economics

James Nolt’s sense tells him that the likely form of quantitative easing in China is about more than economics, but rather a struggle of power and control.

|

New China QE Details Emerge, Stock Market Likely Beneficiary

Reports on Tuesday tell us the program will copy one of the European Central Bank’s initiatives, rather than the Fed’s classic stimulus.

|

China Is Thinking About QE, but What Good Will It Do?

After sending mixed signals to the market over recent weeks, sometimes stimulating, sometimes impeding markets, China might go all in and officially launch quantitative easing.

|

Investors Expect Higher Stocks in 2015, but Also Turbulence

Can the U.S. hold everyone else above water? That is the question investors are asking as Wall Street heads into 2015.

|

Bank of Japan Steps Up After Fed Steps Out

The U.S.’s lights are once again shining most brightly after the Bank of Japan gave markets a big Halloween treat—or will that prove to be a trick?

|

Wall Street Caps a Wild Month With a Rally

For stock investors, there was no shortage of drama in October.

|

US Economy Rallies to Solid 3rd-Quarter Growth

The U.S. economy powered its way to a respectable growth rate of 3.5 percent from July through September, outpacing most of the developed world and on track to extend the momentum through the end of the year and beyond.

|

Fed Upgrades Labor Market, Ends QE

The Federal Open Market Committee (FOMC) ended its quantitative easing (QE) program and upgraded its outlook on the US economy.

|

Stocks Slip as Investors Await Fed Statement

Major U.S. stock indexes slipped in afternoon trading Wednesday as investors waited for word from the Federal Reserve and mulled over a mixed batch of corporate earnings results.

|

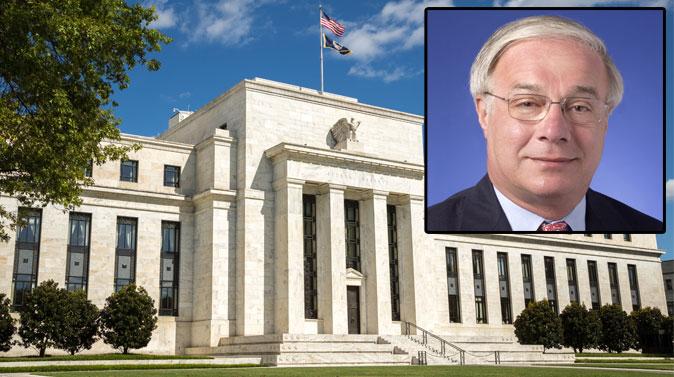

Professor David Wyss on US Economic Recovery, QE, Housing

Dr. David Wyss believes the Fed is “hitting it as hard as they can,” with QE as the U.S. economic recovery moves at half-speed.

|

Peter Schiff Sees Dark Days Ahead for US Economy

Peter Schiff is a noted contrarian. He believes the U.S. is in a worse position than growth-challenged Europe since quantitative easing did not work and is akin to “trying to put out a fire with gasoline.” Schiff also believes the U.S. has worse problems than Japan.

|

The Euro Is Not Overvalued (Nor Is Any Other Currency)

A common argument for dumping the Euro is that it is overvalued, and that the European Central Bank is unwilling to correct this so-called “problem.”

|

Larry Summers Withdraws From Fed Chair Consideration

President Barack Obama said on Sunday that he accepted Lawrence Summers’ decision to withdraw from consideration for the role of Chairman of the Federal Reserve.

|

What Really Happens When the Fed Hikes Rates

It’s not as easy as pushing a button.

|

America Invented QE, but China Has Now Confirmed It Will Use the European Version

According to the newest leaks, however, China will use the European approach to take credit risk out of the market.

|

Bank of China Pushes the Stock Market Booster Again

Another week, another effort by the Chinese authorities to boost the economy. This time the People’s Bank of China (PBOC) lowered its benchmark interest rate by 0.25 percent to 5.10 percent.

|

Is It Really That Bad? The Truth Behind China’s QE Talk

The signs are increasing China will soon engage in its own form of quantitative easing, in what could be seen as a sign of panic.

|

China QE Could Be About More Than Economics

James Nolt’s sense tells him that the likely form of quantitative easing in China is about more than economics, but rather a struggle of power and control.

|

New China QE Details Emerge, Stock Market Likely Beneficiary

Reports on Tuesday tell us the program will copy one of the European Central Bank’s initiatives, rather than the Fed’s classic stimulus.

|

China Is Thinking About QE, but What Good Will It Do?

After sending mixed signals to the market over recent weeks, sometimes stimulating, sometimes impeding markets, China might go all in and officially launch quantitative easing.

|

Investors Expect Higher Stocks in 2015, but Also Turbulence

Can the U.S. hold everyone else above water? That is the question investors are asking as Wall Street heads into 2015.

|

Bank of Japan Steps Up After Fed Steps Out

The U.S.’s lights are once again shining most brightly after the Bank of Japan gave markets a big Halloween treat—or will that prove to be a trick?

|

Wall Street Caps a Wild Month With a Rally

For stock investors, there was no shortage of drama in October.

|

US Economy Rallies to Solid 3rd-Quarter Growth

The U.S. economy powered its way to a respectable growth rate of 3.5 percent from July through September, outpacing most of the developed world and on track to extend the momentum through the end of the year and beyond.

|

Fed Upgrades Labor Market, Ends QE

The Federal Open Market Committee (FOMC) ended its quantitative easing (QE) program and upgraded its outlook on the US economy.

|

Stocks Slip as Investors Await Fed Statement

Major U.S. stock indexes slipped in afternoon trading Wednesday as investors waited for word from the Federal Reserve and mulled over a mixed batch of corporate earnings results.

|

Professor David Wyss on US Economic Recovery, QE, Housing

Dr. David Wyss believes the Fed is “hitting it as hard as they can,” with QE as the U.S. economic recovery moves at half-speed.

|

Peter Schiff Sees Dark Days Ahead for US Economy

Peter Schiff is a noted contrarian. He believes the U.S. is in a worse position than growth-challenged Europe since quantitative easing did not work and is akin to “trying to put out a fire with gasoline.” Schiff also believes the U.S. has worse problems than Japan.

|

The Euro Is Not Overvalued (Nor Is Any Other Currency)

A common argument for dumping the Euro is that it is overvalued, and that the European Central Bank is unwilling to correct this so-called “problem.”

|

Larry Summers Withdraws From Fed Chair Consideration

President Barack Obama said on Sunday that he accepted Lawrence Summers’ decision to withdraw from consideration for the role of Chairman of the Federal Reserve.

|