Focus

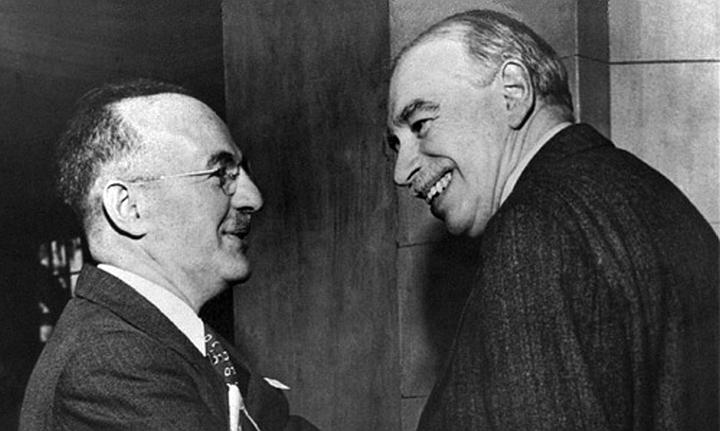

John Maynard Keynes

LATEST

|

Why Workers Don’t Need to Fear Technological Change

In economics, nobody likes it but everybody has to live with it: uncertainty. It makes business decisions difficult and wreaks havoc in economic models. This is why mainstream economics oftentimes ignores it and assumes we have complete certainty in economic planning. In real life, this assumption never pans out, which is part of the reason mainstream economics is notoriously bad at predicting financial crises.

|

Why the Mainstream Fails to Understand Recessions

In a 2010 Bloomberg Television interview, Alan Greenspan said, “The general notion the Fed was propagator of the bubble by monetary policy does not hold up to the evidence. ... Everybody missed it — academia, the Federal Reserve, all regulators.” Everybody missed it?

|

The Moral Imperative of the Market

The problem I had first identified in studying industrial fluctuations — that false price signals misdirected human efforts — I then followed up in various other branches of the discipline.

|

|

Why Workers Don’t Need to Fear Technological Change

In economics, nobody likes it but everybody has to live with it: uncertainty. It makes business decisions difficult and wreaks havoc in economic models. This is why mainstream economics oftentimes ignores it and assumes we have complete certainty in economic planning. In real life, this assumption never pans out, which is part of the reason mainstream economics is notoriously bad at predicting financial crises.

|

Why the Mainstream Fails to Understand Recessions

In a 2010 Bloomberg Television interview, Alan Greenspan said, “The general notion the Fed was propagator of the bubble by monetary policy does not hold up to the evidence. ... Everybody missed it — academia, the Federal Reserve, all regulators.” Everybody missed it?

|

The Moral Imperative of the Market

The problem I had first identified in studying industrial fluctuations — that false price signals misdirected human efforts — I then followed up in various other branches of the discipline.

|