Focus

currency wars

LATEST

Canadian Dollar Favoured While Yuan Wreaks Havoc in Markets

But the net impact on the Canadian dollar is probably quite small, says Greg Anderson, global head of foreign exchange strategy at BMO.

|

How the China Crash Influences World Markets

Yes China is closed off from the global financial system. But then again, subprime was too.

|

Bernanke Is Right About China

According to the former Fed Chairman, opening up has both advantages and disadvantages.

|

The Tug of War Behind China’s Bid to Become a Financial Superpower

Behind the scenes, China’s bid to increase its power at the IMF has turned into a fierce negotiation about who will control global finance in the future.

|

Will China Join the Currency Wars?

For years we have heard the Chinese currency is undervalued relative to the U.S. dollar and should appreciate. This is no longer true

|

Currency Wars Fool Few in the Age of Social Media

Currency wars are back on for many countries around the world.

|

The Folly of (Currency) War

Investors have been repeatedly admonished this past year or two not to underestimate the power of central banks in driving up financial asset values.

|

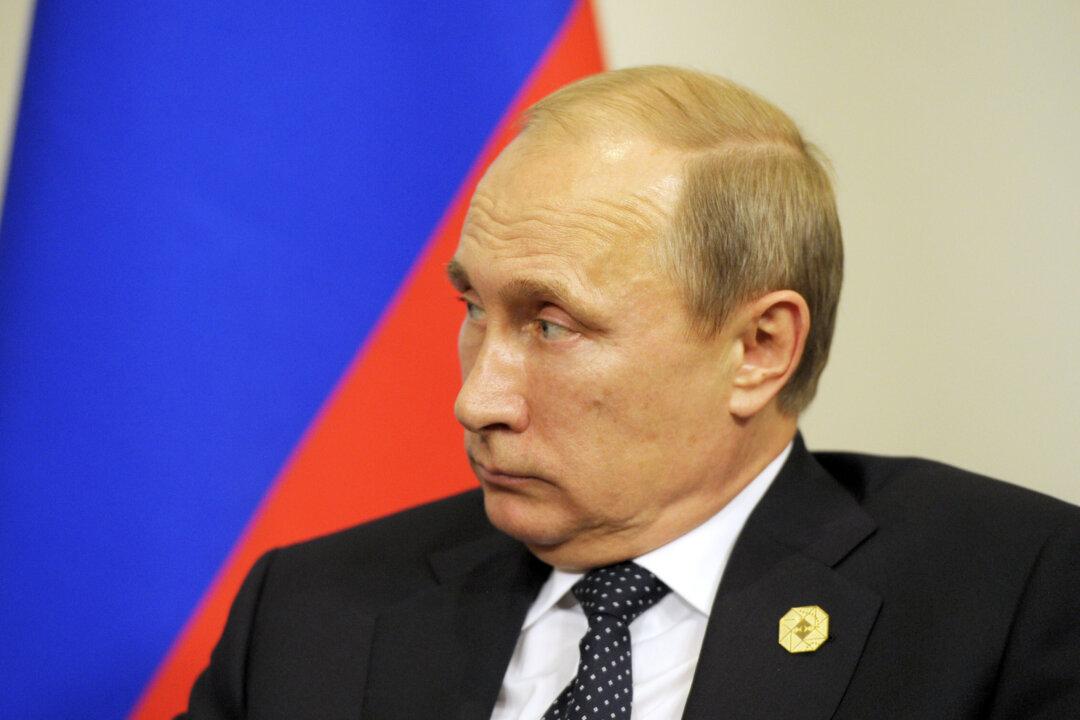

10 Signs (& Causes) Russia’s Economy Is in Serious Trouble

A confluence of forces have besieged the former communist country, creating a perfect economic storm. The ruble is tumbling at an alarming rate, but that’s not all, here are some of the factors.

|

The Russian Ruble Roulette

Some countries are desperate for it, some countries are desperate to avoid it: A weak currency. While Japan, the United States, and Europe are printing money to weaken their currencies, Russia is buying up billions of dollars worth of rubles to stem a decline, which has brought the currency down by 17 percent this year against the dollar.

|

Interview With James Rickards: China Planning to Displace Dollar

Epoch Times: Mr. Rickards, in our last interview, we talked about gold and why it should rally. You also said the Chinese are behind buying a lot of physical ...

James Rickards: I met with the largest gold refinery in the world, the head of precious metals operations. He’s recently expanded his own capacity; they put a whole new area in their factory and it’s highly automated. And he’s working triple shifts, he is working 24 hours a day to produce gold.

|

Interview With James Rickards: Gold Set for Massive Rally

James Rickards, the author of the best-selling book “Currency Wars,” talks about his new book and why gold will rally in 2014.

|

Japanese Trade Deficit Surges in January

Japanese trade figures released for January show that its trade deficit increased by 10 percent over the last year.

|

G-7 Plays Down Currency War Risk

Finance ministers of the G-7 nations met Feb. 12 in Marseille, France, to discuss global economic issues. The focal point of the discussion was the exchange rate policy.

|

Canadian Dollar Favoured While Yuan Wreaks Havoc in Markets

But the net impact on the Canadian dollar is probably quite small, says Greg Anderson, global head of foreign exchange strategy at BMO.

|

How the China Crash Influences World Markets

Yes China is closed off from the global financial system. But then again, subprime was too.

|

Bernanke Is Right About China

According to the former Fed Chairman, opening up has both advantages and disadvantages.

|

The Tug of War Behind China’s Bid to Become a Financial Superpower

Behind the scenes, China’s bid to increase its power at the IMF has turned into a fierce negotiation about who will control global finance in the future.

|

Will China Join the Currency Wars?

For years we have heard the Chinese currency is undervalued relative to the U.S. dollar and should appreciate. This is no longer true

|

Currency Wars Fool Few in the Age of Social Media

Currency wars are back on for many countries around the world.

|

The Folly of (Currency) War

Investors have been repeatedly admonished this past year or two not to underestimate the power of central banks in driving up financial asset values.

|

10 Signs (& Causes) Russia’s Economy Is in Serious Trouble

A confluence of forces have besieged the former communist country, creating a perfect economic storm. The ruble is tumbling at an alarming rate, but that’s not all, here are some of the factors.

|

The Russian Ruble Roulette

Some countries are desperate for it, some countries are desperate to avoid it: A weak currency. While Japan, the United States, and Europe are printing money to weaken their currencies, Russia is buying up billions of dollars worth of rubles to stem a decline, which has brought the currency down by 17 percent this year against the dollar.

|

Interview With James Rickards: China Planning to Displace Dollar

Epoch Times: Mr. Rickards, in our last interview, we talked about gold and why it should rally. You also said the Chinese are behind buying a lot of physical ...

James Rickards: I met with the largest gold refinery in the world, the head of precious metals operations. He’s recently expanded his own capacity; they put a whole new area in their factory and it’s highly automated. And he’s working triple shifts, he is working 24 hours a day to produce gold.

|

Interview With James Rickards: Gold Set for Massive Rally

James Rickards, the author of the best-selling book “Currency Wars,” talks about his new book and why gold will rally in 2014.

|

Japanese Trade Deficit Surges in January

Japanese trade figures released for January show that its trade deficit increased by 10 percent over the last year.

|

G-7 Plays Down Currency War Risk

Finance ministers of the G-7 nations met Feb. 12 in Marseille, France, to discuss global economic issues. The focal point of the discussion was the exchange rate policy.

|