PUNTA GORDA, Fla.–On Aug. 16, small business owners and independent contractors across Florida became fearful of their futures as Gov. Ron DeSantis questioned the sanity of Washington.

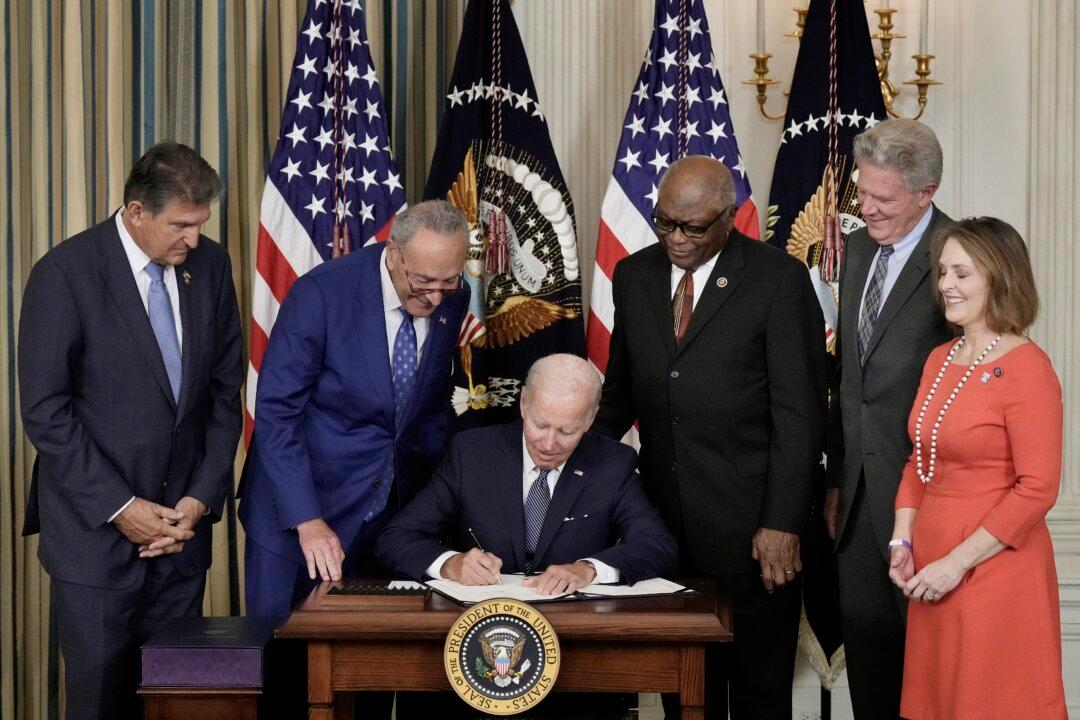

On that day, President Joe Biden signed into law the “Inflation Reduction Act,” giving the IRS nearly $80 billion, with $45.6 billion going towards “enforcement,” which requires hiring more agents.