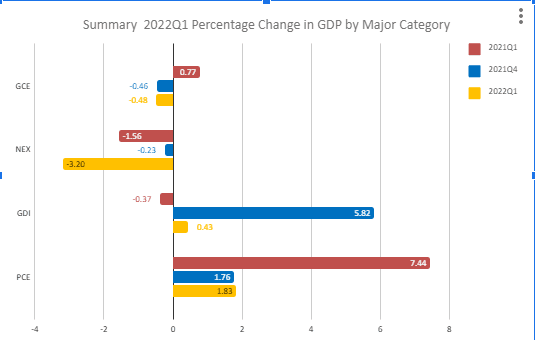

- Topline GDP printed down 1.4 percent versus a consensus estimate of 1.1 percent up.

- Personal consumption expenditures (PCE) were sharply lower, year-on-year, as the economy normalizes

- The backlog of container ships that stood offshore at the end of last year has largely been cleared, and the U.S. has imported more oil and gas at higher prices, having a negative effect on the net exports (NEX) component of GDP and pushing the entire GDP print negative.

- Given that anomaly, the Federal Reserve is still likely to push rates higher when it meets May 4-6.

- Gross domestic investment (GDI) dropped as rates increased and concerns about business conditions increase.

First Quarter GDP Prints Down 1.4 Percent; Likely an Import Anomaly

Clearance of backed up containers cut GDP by 3.2 percentage points

A sailboat passes cargo containers stacked at the Port of Los Angeles, the nation’s busiest container port, in San Pedro, Calif., on Oct. 15, 2021. Mario Tama/Getty Images

|Updated: