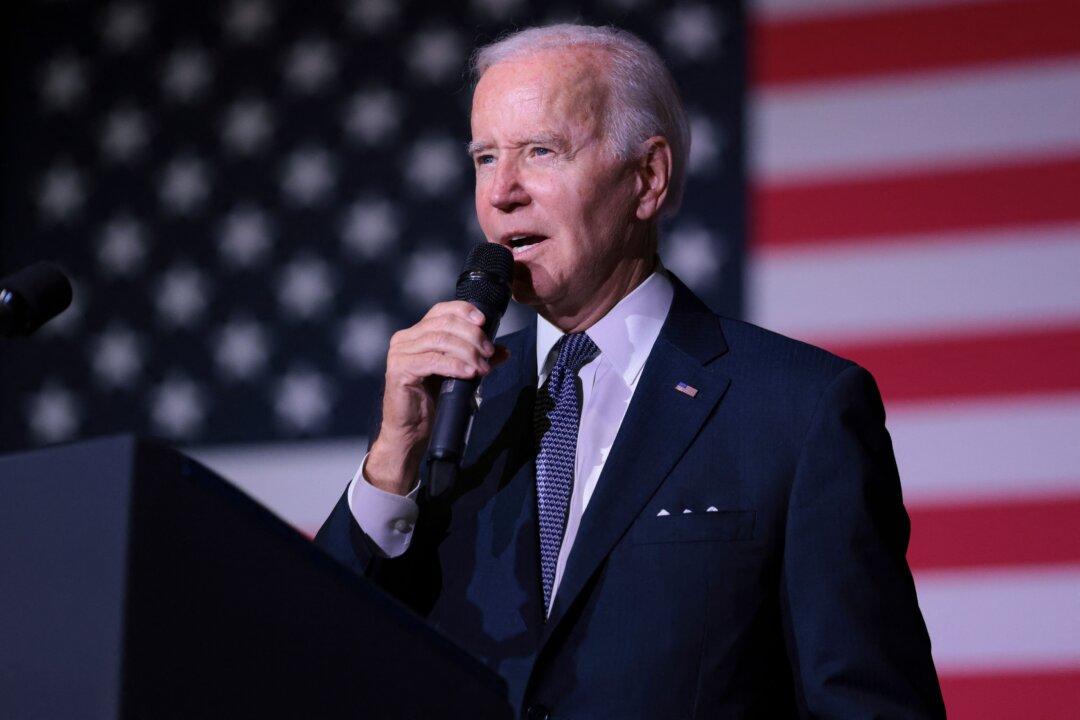

The Biden administration on Friday released its budgetary data for the last month of fiscal year 2022 which showed the U.S. government ran up a roughly $1.4 trillion deficit. That is an average of nearly $120 billion in added debt every month.

Federal debt surpassed $31 trillion earlier this month. The federal debt topped $30 trillion, its own milestone, in January of this year.