Many aspiring homeowners see a land contract as the answer to their prayers, although mortgage experts and lawyers say they almost always result in financial calamity.

“Land contracts and leases with an option to buy are both costly and destructive detours that diminish the likelihood that consumers entering these contracts will ever own a home,” said Sarah B. Mancini, co-director of advocacy for the National Consumer Law Center.

“We estimate that more than half of these transactions fail. Indeed, we believe that these transactions are designed to fail.”

She testified before the Senate Banking Committee’s Subcommittee on Housing, Transportation, and Community Development on July 11.

Land contracts, contract for deed, and lease with an option to own arrangements disproportionately target low-income minority home buyers who typically can’t qualify for traditional mortgages, Ms. Mancini and other witnesses said.

The plans are arrangements between buyers and sellers in which the parties agree on a selling price and payment plan. Many states don’t require the deals to be recorded with the court.

Regulations differ from state to state, and many buyers know little about real estate transactions. So they don’t take advantage of the law because they don’t realize that they may have legal rights.

The buyer takes on the responsibilities of a homeowner or landlord but has none of the protections afforded by law in a more traditional mortgage. In a land contract, the buyer is responsible for all repairs, taxes, liens, and other expenses, although the seller retains ownership.

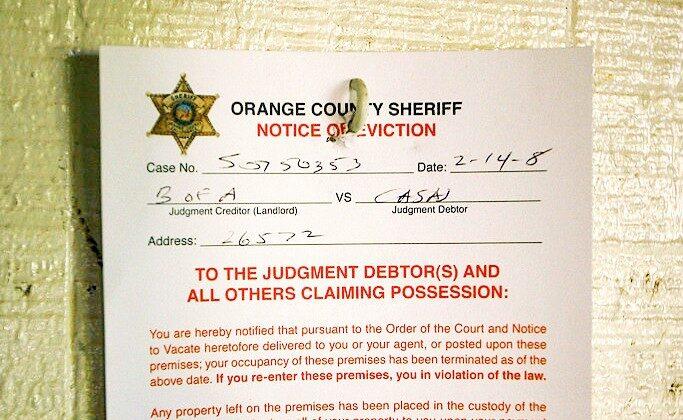

In many cases, buyers get uninhabitable homes. They may make thousands of dollars worth of improvements, only to be evicted when they miss a payment or can’t make an agreed-upon balloon payment.

The deals generally don’t require property inspections, title searches, or other requirements that go along with getting a mortgage from a financial institution.

Ms. Mancini said this creates a minefield of possible hazards.

“No one should purchase a home without having a lawyer do a title search to make sure the person selling it actually has a good title,” Ms. Mancini said.

The deals often come with high-interest rates, inflated asking prices, and nonrefundable deposits and fees.

Sen. Tina Smith (D-Minn.), who chairs the subcommittee, said the practice began in the 1960s and reappeared after the financial crisis of 2008, when the housing market was flooded with foreclosed properties.

“Typically, they’re targeting black and brown and immigrant communities, poor communities, groups that have long suffered from housing discrimination,” she said.

Ms. Smith pointed out that a traditional mortgage or rental contract requires specific steps to be taken if the buyer is to be evicted. In those instances, the buyer is liable for unpaid debt and fees but can keep any equity built up during the contract.

It’s different in a land contract: The buyer can be evicted for a single missed payment and loses all of their money.

“If they default on those payments, there is no requirement in Minnesota law they get any of their money,” said Elizabeth Goodell of the Mid-Minnesota Legal Aid.

Many of her clients have been taken in by unscrupulous contracts for deed businesses. She said that in Minnesota, the land contract is called a contract for deed.

The buyers often have never bought a home, so they don’t understand the process. Often, they speak little or no English or feel they have nowhere else to turn because of bad credit or a lack of credit.

In a lease with an option-to-buy plan, the buyer leases the property for a set time and pays a fee for the option to buy the property when the lease runs out. If the buyer doesn’t execute the purchase option, they lose the fee and can be evicted.

Many Buyers Should Rent Instead

“Contract for deed buyers most frequently come to our attention ... when they are being evicted,” Ms. Goodell said.

She noted that many clients would be good candidates for affordable rental units. This also means that they would be good prospects for small mortgages. However, many lenders don’t want to handle mortgages lower than $125,000 because they typically don’t realize a good return on their investment.

That’s a common issue that leads people into a contract for deed arrangements, according to John Green, managing principal of Blackstar Stability.

“I think that below a certain threshold, proportionate and fixed costs proportionately make it much less desirable,” he said.

There Are Alternatives

Mr. Green said that doesn’t have to be the case.

His Maryland-based company began as a state-funded program in 2007 after the Great Recession and real estate downturn. The program helped homebuyers who had been trapped in one-sided and unfair contracts refinance their homes.

According to the company’s website, when the state program ended, Blackstar went national and reached out to private investors. His company connects those investors with distressed buyers, many of whom have mortgages of $100,000 or less.

Blackstar has the resources to absorb the initial expenses, such as unpaid fees and late payments, allowing homebuyers to keep their properties and investments.

Mr. Green and the other witnesses said part of the problem is that there’s no system for tracking these private transactions. The patchwork of state regulations makes it difficult for homebuyers to know when they’re being taken advantage of.

They recommended that Congress look into ways to track these deals and provide incentives for lenders to provide small mortgages so that prospective homebuyers have an alternative to these risky arrangements.