I’ve speculated before that most of the readers of my column are women. And that conjecture is based on the fact that I seem to get many more emails from them than I get from men. That’s why, for example, in the past month, I’ve written two columns targeted to my female readers. But I guess I didn’t do a very good job of helping them understand the Social Security program, because those columns seem to have generated even more emails from women. Here is a sampling.

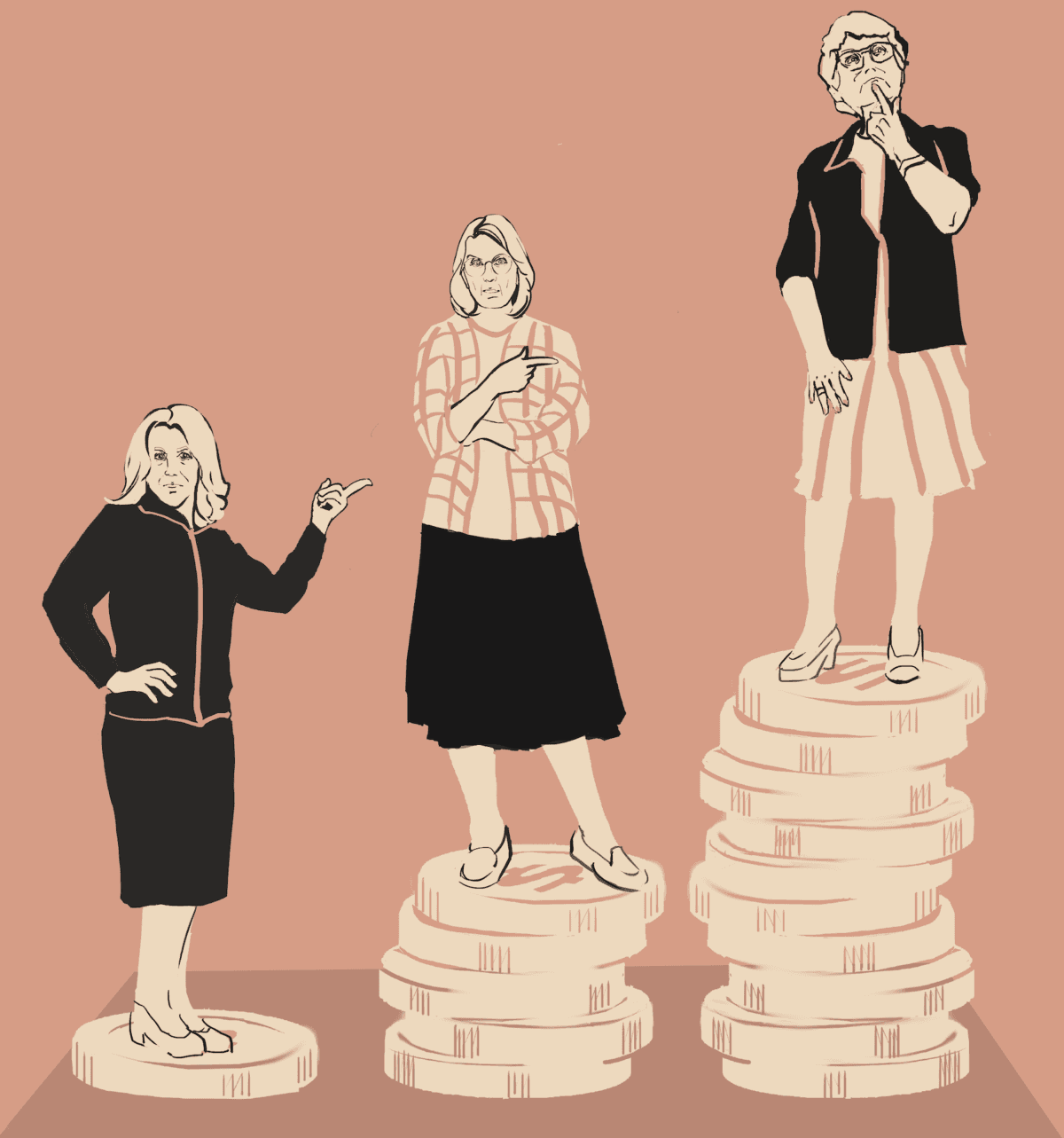

This week's column clears up some questions about different rates for spousal benefits. Fei Meng