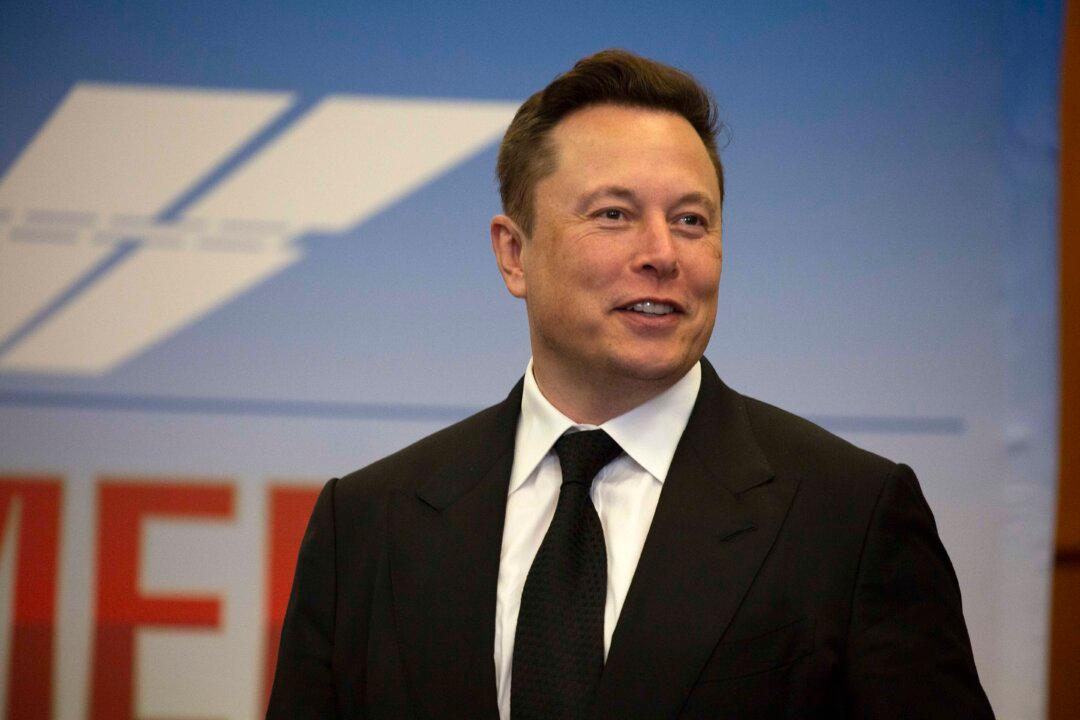

Tesla chief executive Elon Musk said Friday that he sees an end to the semiconductor supply shortage in relatively short order thanks to new chip plants being planned and already under construction.

“There’s a lot of chip fabrication plants that are being built,” Musk said via video uplink at an Italian Tech Week event. “I think we will have good capacity for providing chips by next year.”