WASHINGTON—The U.S. economy had a blockbuster second quarter, with gross domestic product surging 4.1 percent, its fastest pace since 2014.

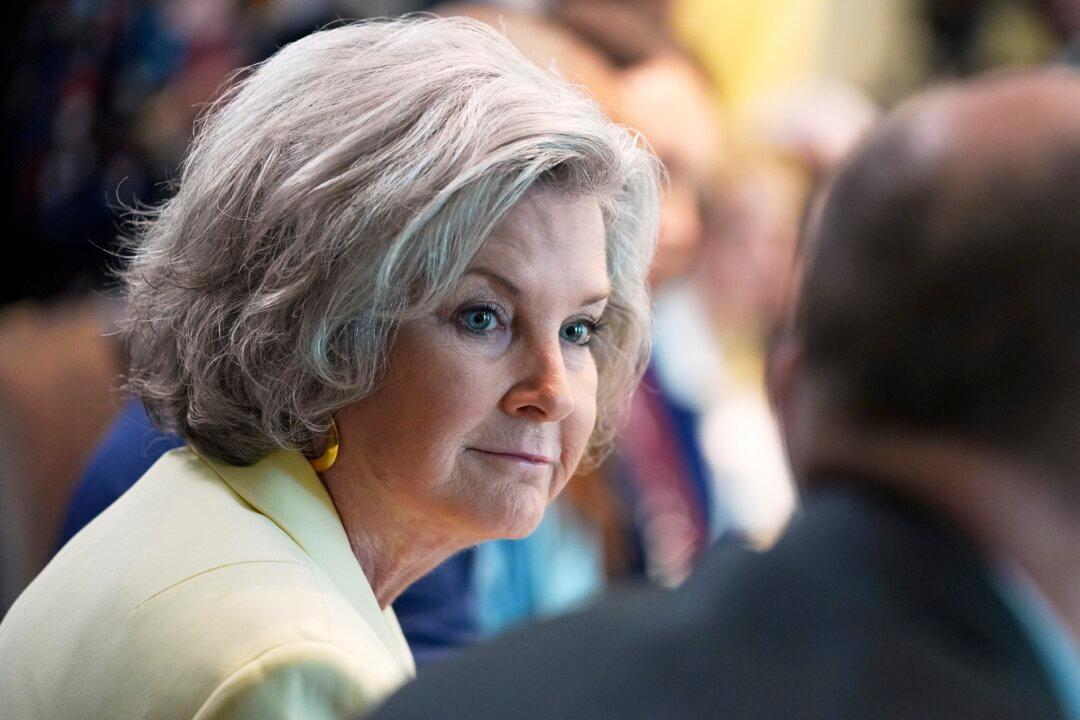

President Donald Trump delivers remarks, as Vice President Mike Pence looks on, about the economy and second quarter GDP growth of 4.1% on the South Lawn of the White House in Washington on July 27, 2018. Samira Bouaou/The Epoch Times

Emel Akan

Reporter

|Updated:

Emel Akan is a senior White House correspondent for The Epoch Times, where she covers the policies of the Trump administration. Previously, she reported on the Biden administration and the first term of President Trump. Before her journalism career, she worked in investment banking at JPMorgan. She holds an MBA from Georgetown University.

Author’s Selected Articles