Companies are starting to drill for lithium in the Salton Sea in Southern California, although that may not be enough to supply the growing demand for the mineral, which is crucial for the development of “green energy.”

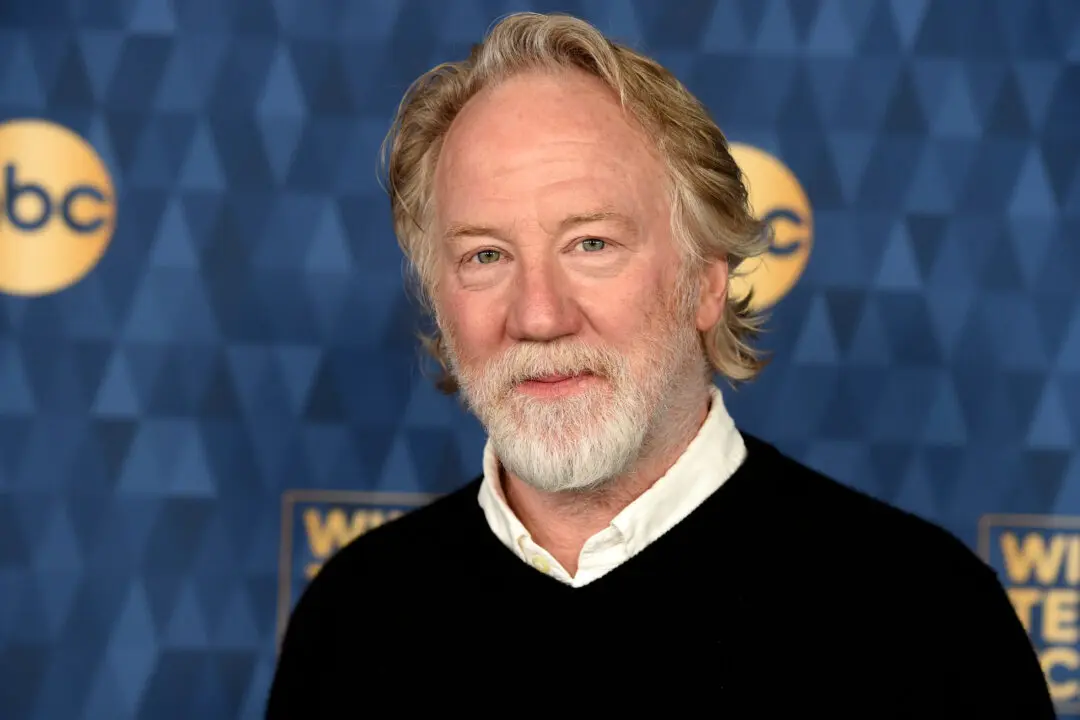

“The global battery arms race has become a global battery supply chain race,” Simon Moores, CEO of Benchmark Mineral Intelligence, a research organization specializing in the lithium industry, wrote on Twitter on March 30.