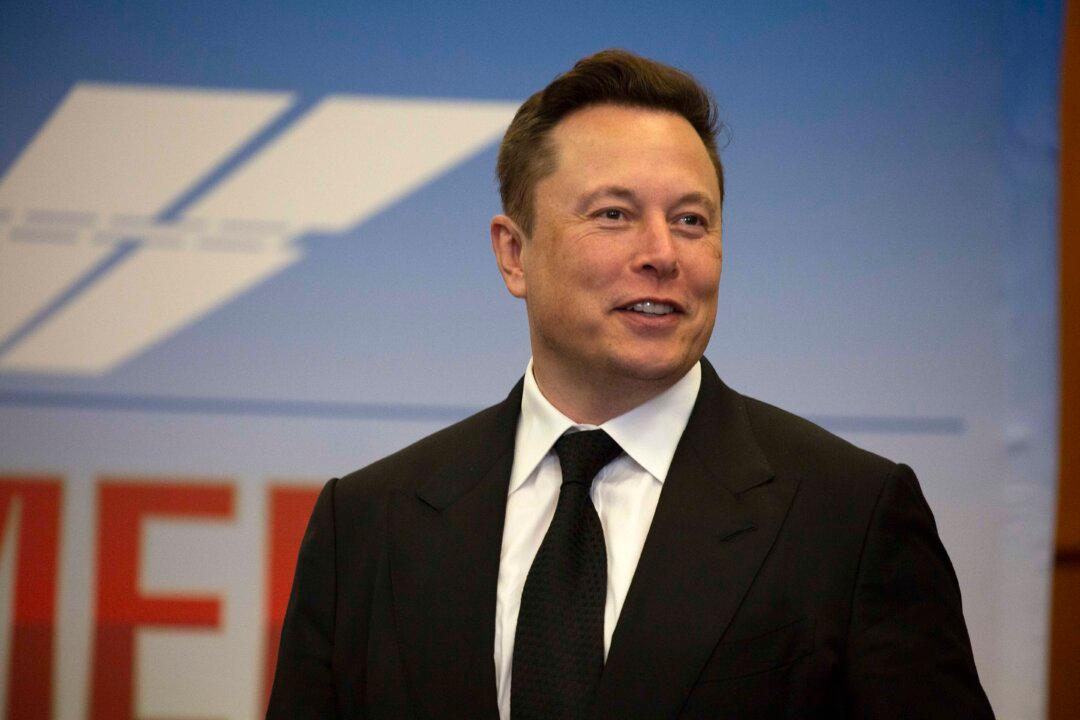

Tesla Inc. chief executive officer Elon Musk has advised entrepreneurs to get into the lithium business as he seeks to expand the fast-growing industry that is crucial for products such as electric vehicles (EV).

“We think we’re going to need to help the industry on this front,” Musk said on an earnings call on Wednesday. “I certainly encourage entrepreneurs out there who are looking for opportunities to get into the lithium business.”