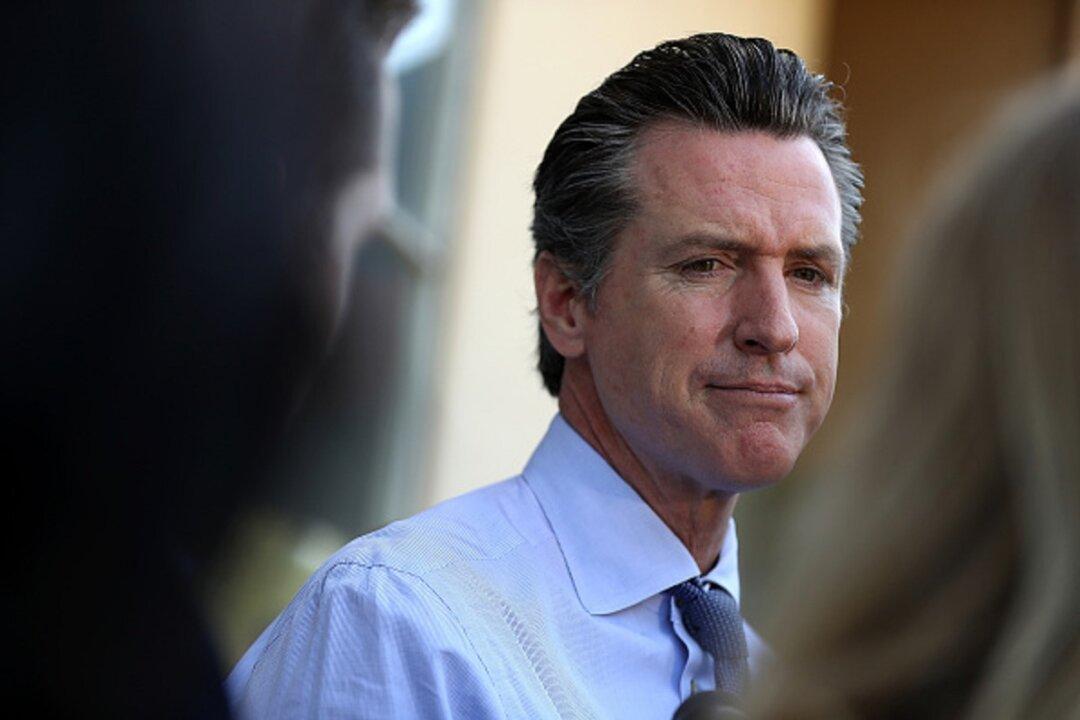

California has long struggled with budget problems, which have persisted regardless of who’s in charge of governing the state. But when Gov. Gavin Newsom took over, he promised the Golden State had already been pulled “back from the brink of fiscal insolvency.”

Newsom claimed (pdf) the state was “finally tearing down the remaining wall of budgetary debt, paying down pension obligations, and building up the most robust and prudent budget reserve in state history.”