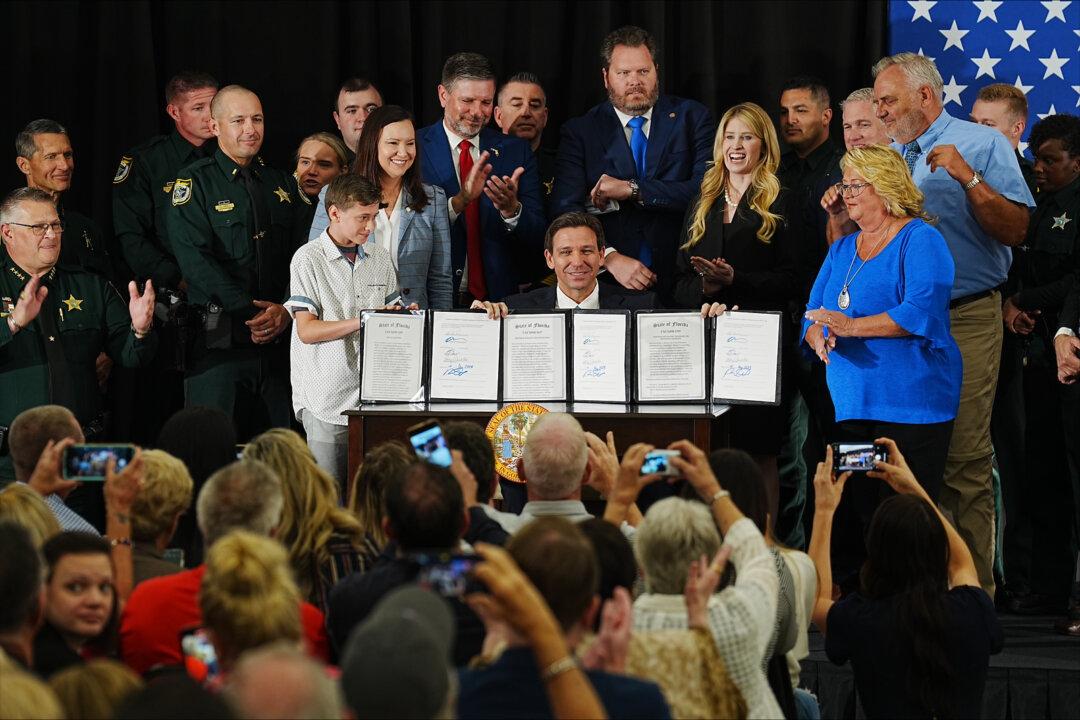

Florida Gov. Ron DeSantis signed into law a bill curbing financial companies’ use of ESG principles to govern investment or lending decisions in the state.

According to DeSantis ESG—environmental, social, and governmental—has become a backdoor way for companies to impose woke values on communities that would never approve such things at the ballot box.