In the aftermath of two failed banks, the crypto-focused Signature Bank and the 16th largest U.S. depository Silicon Valley Bank (SVB), economists are questioning the role of the Federal Reserve in the banking crisis.

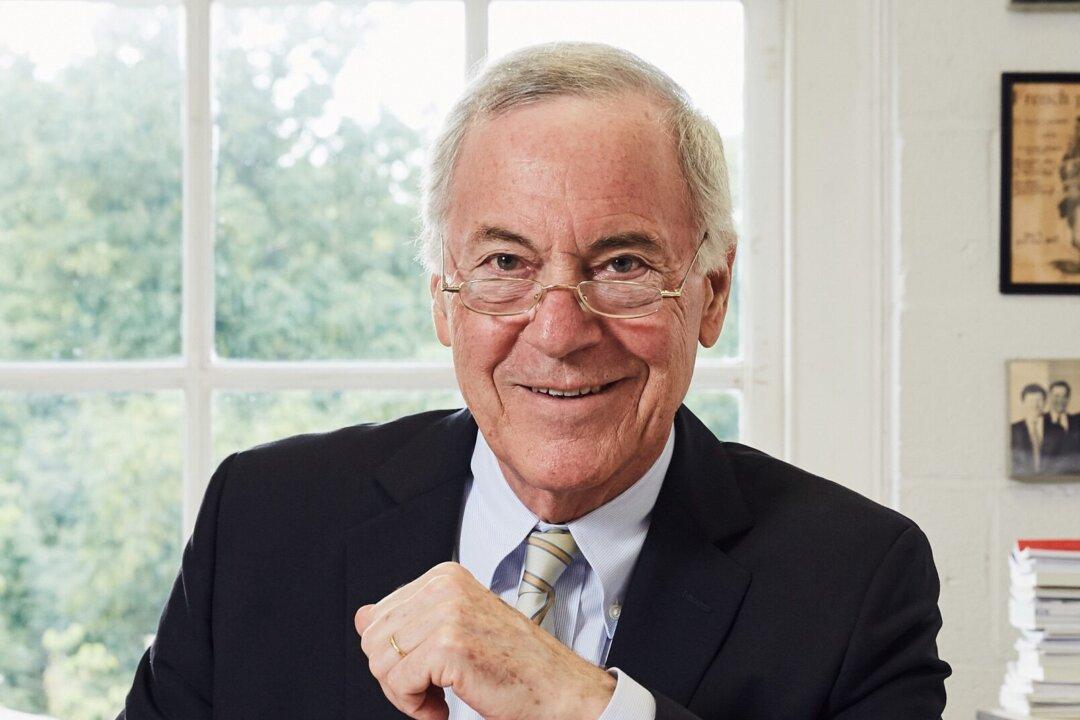

Former economic adviser to President Ronald Reagan, Steve Hanke believes that the Fed’s contractionary policies have contributed to the current situation and that the central bank is poised to bring more pain.