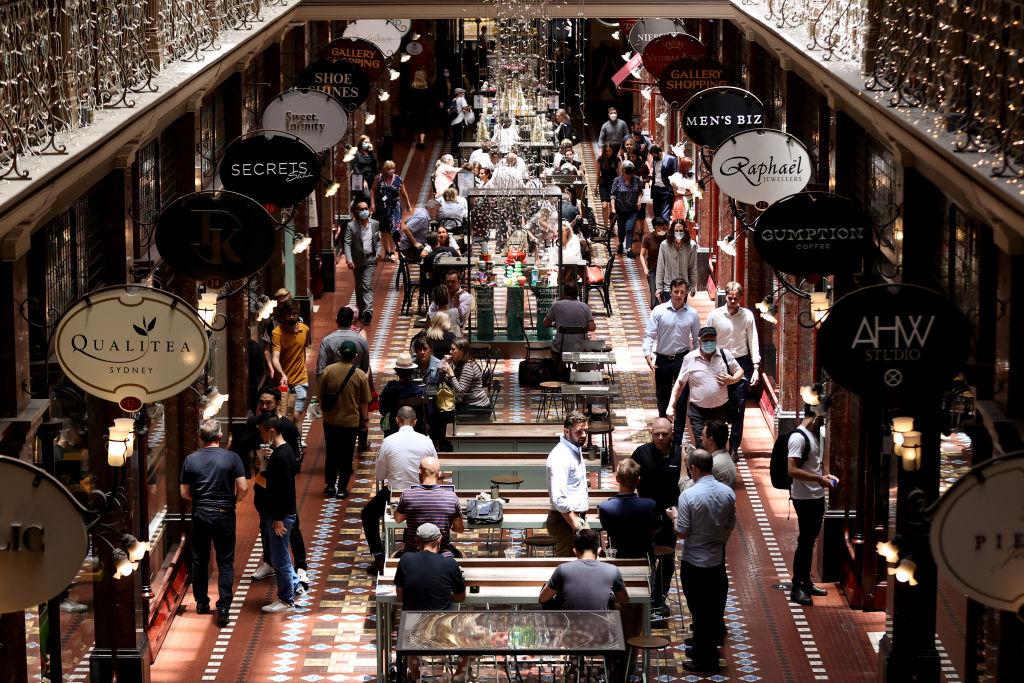

Persistent high levels of demand for workers in Australia has put pressure on wages to rise, but Australians will still be taking a pay cut in real wages.

The National Skills Commission revealed that job advertisements rose by 3.6 percent, or 9,300, in February to a total of 269,700.