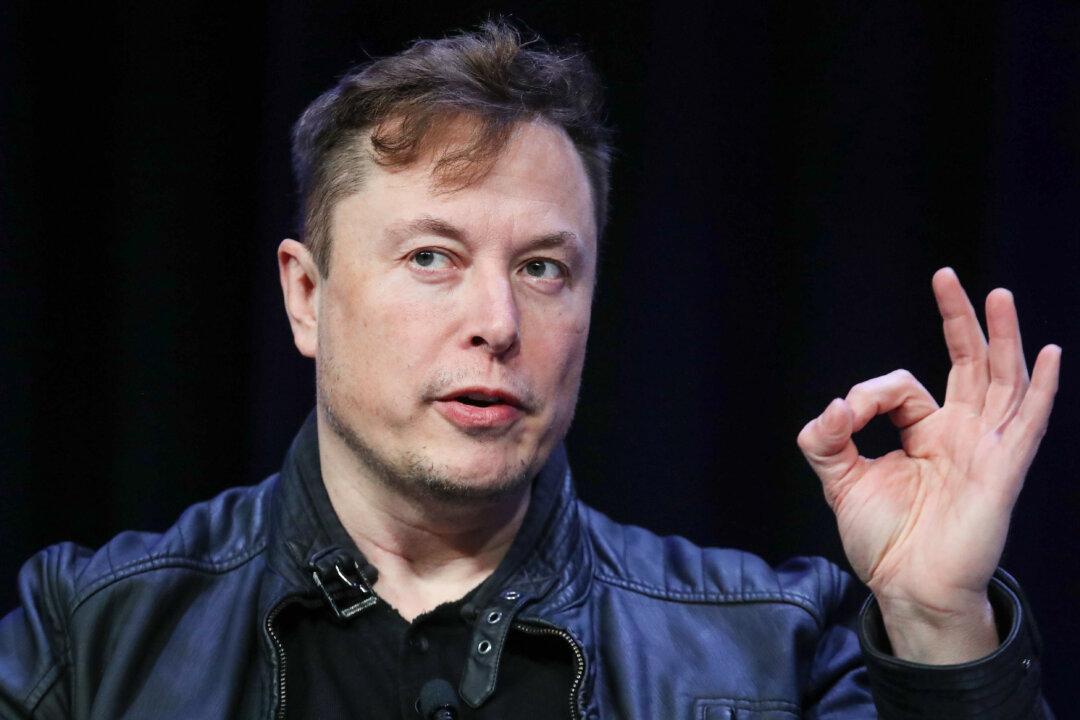

Industrialist Elon Musk stated that delaying the raising of America’s debt ceiling will only make consequences worse, as the United States is only a few weeks away from breaching the limit.

“In the end, all debts must be paid, just a question of when. Later makes it worse,” Musk posted in a May 8 tweet. He was responding to a tweet about Treasury Secretary Janet Yellen’s warning on Sunday that any failure to raise the national debt limit could result in economic chaos. Back in January, Yellen said that the government can only pay its bill through early June with the current debt limit of $31.4 trillion. The limit was hit in January. Washington now only has a few more weeks before the country risks breaching the ceiling.