News Analysis

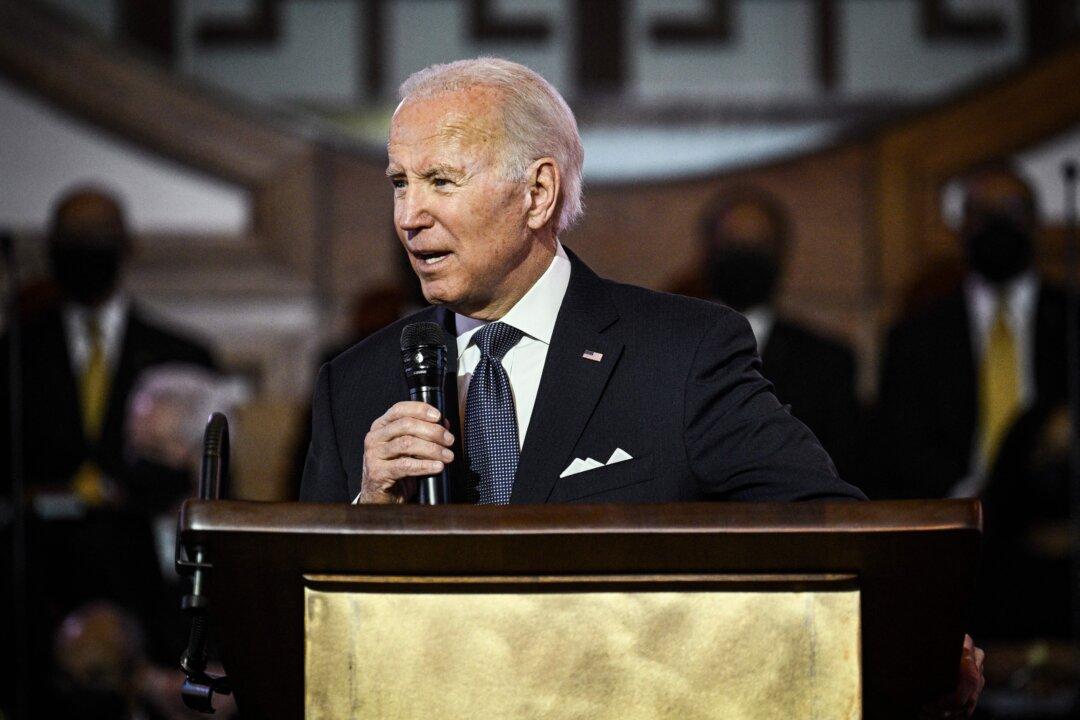

The dramatic showdown between the Biden administration and the new GOP majority in the House of Representatives over the federal debt ceiling is the latest manifestation of an unsustainable fiscal model, in which the U.S. government indulges in discretionary as well as mandatory spending far beyond its means, and if the two sides do reach compromise and avert a default on debt payments, it will be a temporary stalling action rather than a solution to an escalating crisis.