Executives of six cryptocurrency companies urged Congress on Wednesday to clarify regulations, relax restrictions, and bring about tailor-made legislation for the booming $3 trillion sector.

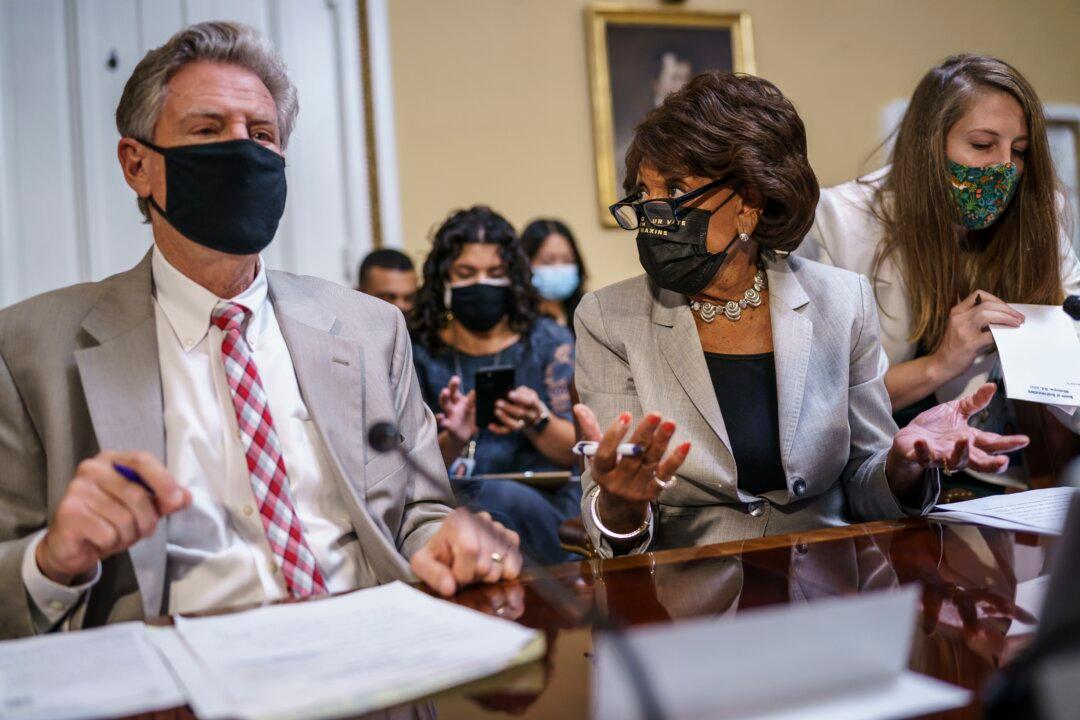

Washington is still figuring out how to manage the decade-old digital asset market in which almost 16 percent of Americans have made at least one transaction. A partisan divide was visible at the House Financial Services Committee hearing where executives explained the technically-advanced industry, and how tougher regulations might send cryptocurrency companies packing off to foreign destinations with more agreeable terms of conduct.