Democrats from the Joint Economic Committee presented a report about the possible consequences of Republicans not raising the debt ceiling.

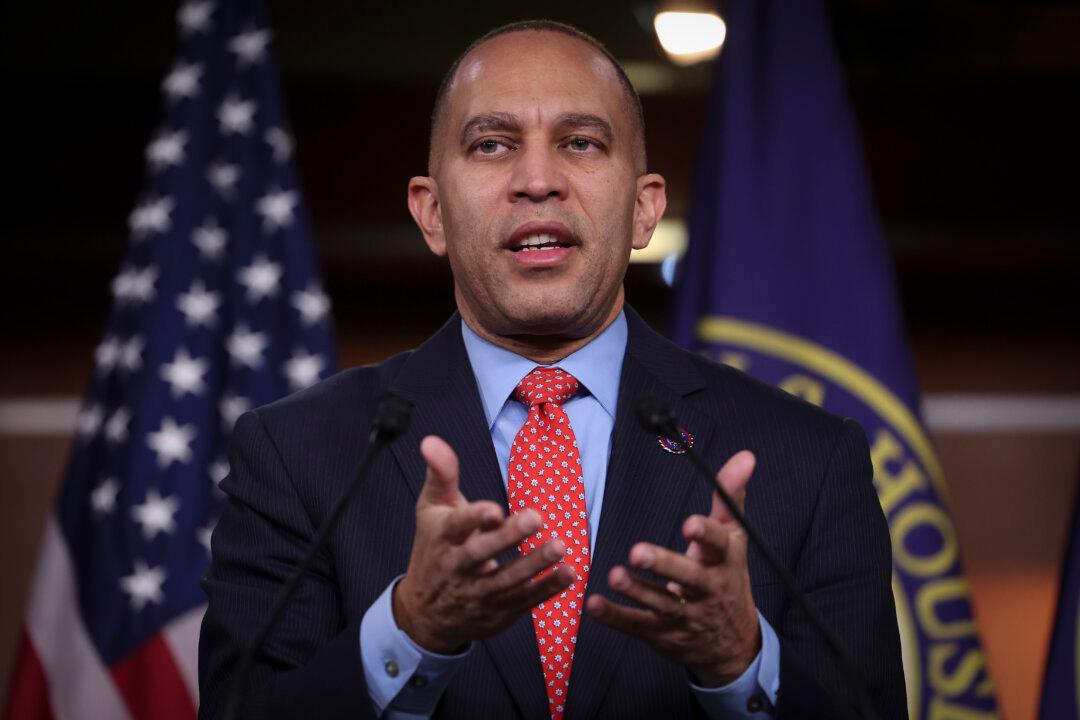

The group was led by Senate Majority Leader Chuck Schumer (D-N.Y.) and House Minority Leader Hakeem Jeffries (D-N.Y.), who warned during a March 23 press conference that the Republican Party’s stance on the debt limit could have severe consequences for American families and the wider economy.