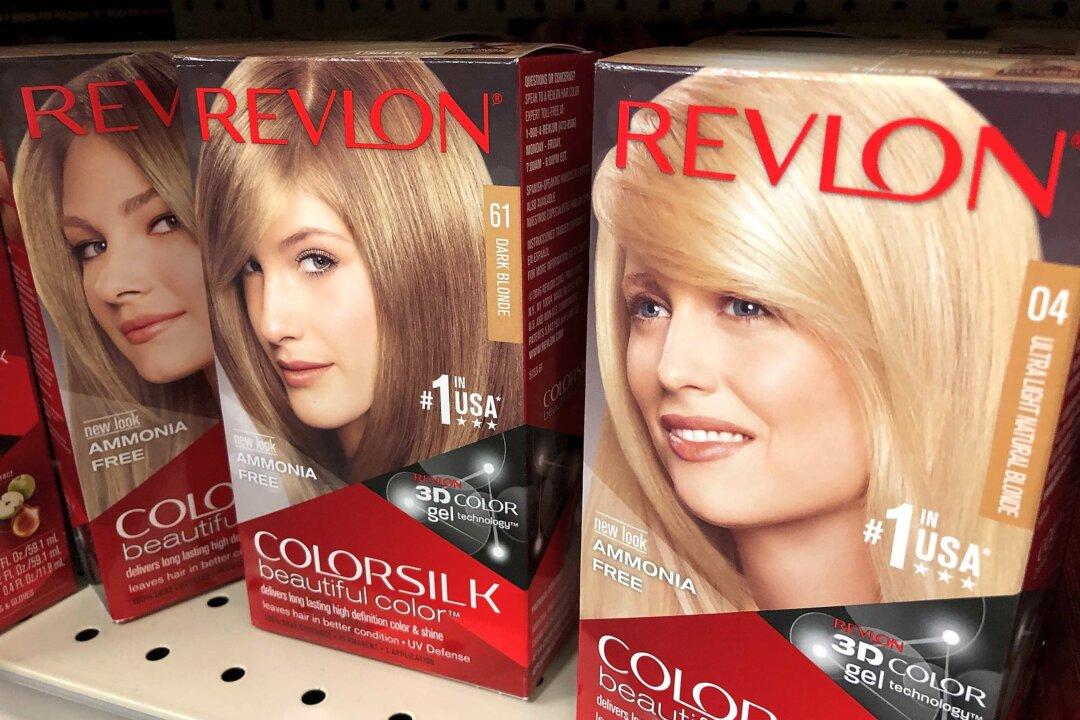

Cosmetics giant Revlon filed for Chapter 11 bankruptcy protection on Wednesday after struggling with debt and competition from online-focused upstart brands and amid soaring inflation levels plus supply chain issues.

The company, owned by billionaire Ron Perelman’s MacAndrews & Forbes, listed assets totaling $2.3 billion as of late April, according to a June 15 filing with the U.S. Bankruptcy Court for the Southern District of New York cited by Bloomberg.