WASHINGTON—Nearly 50 percent of the value of federal electric vehicle (EV) tax credits has been claimed by Californians, according to a coalition of advocacy groups that’s pushing Senate Republicans to defeat the Democrats’ Green New Deal proposal to extend and expand the subsidy.

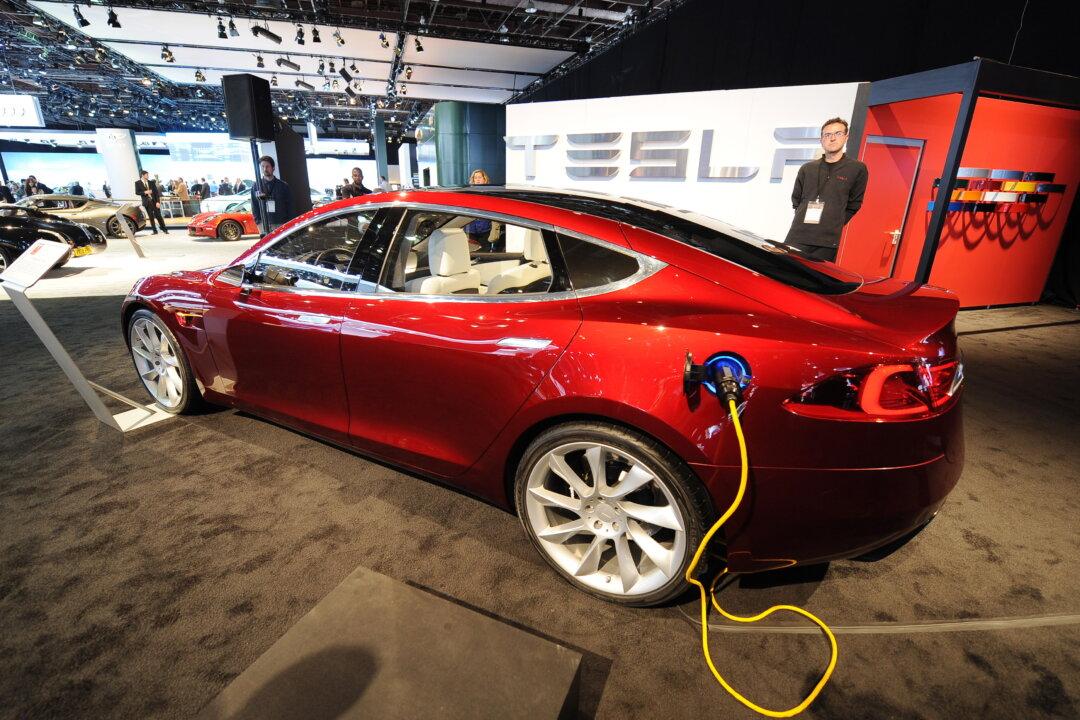

“Democrats have made expanding the electric vehicle subsidy a top priority before Congress wraps up for the year. This move would essentially enrich two auto companies, General Motors and Tesla, along with wealthy coastal elites, mainly from California and New York,” American Energy Alliance (AEA) President Thomas Pyle said in a Dec. 10 statement.