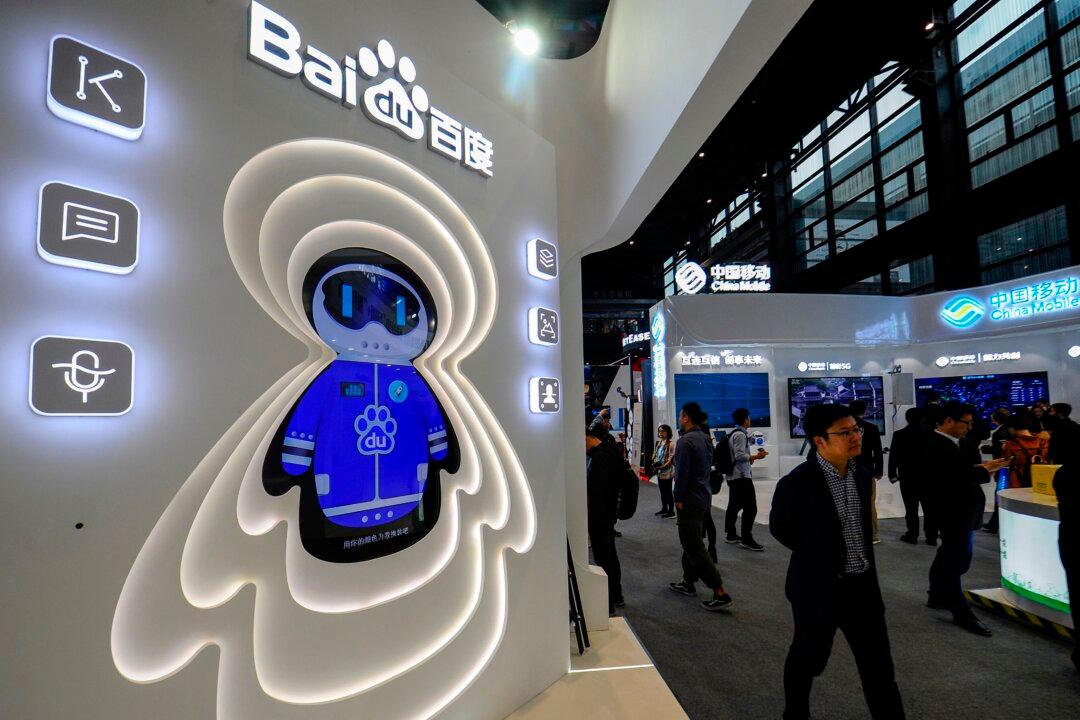

U.S.-traded internet giant Baidu Inc. is one of the latest companies, mostly China-based, to face possible delisting from U.S. stock exchanges unless they abide by auditing standards.

The Securities and Exchange Commission (SEC) added the search engine company on March 30 to its growing provisional list under the Holding Foreign Companies Accountable Act (HFCAA), along with four other firms.