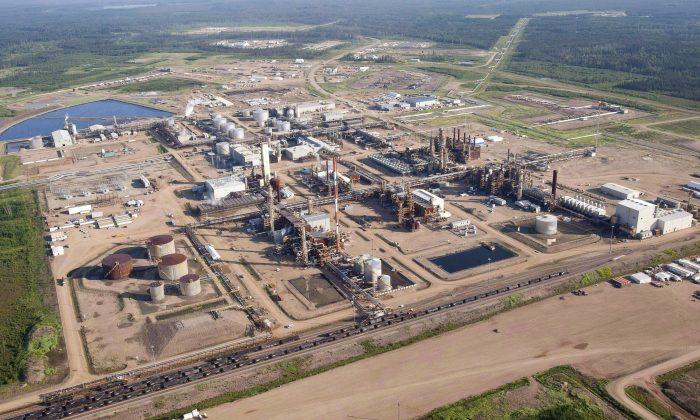

China is selling its oil fields in the United States, Canada, and Britain due to fear of Western sanctions, according to a recent Reuters report. Experts say Beijing’s over-reliance on U.S. markets and technologies could be fatal in the case of being sanctioned or losing its overseas assets.

“It is impossible to predict whether the business of the Company or its affiliates … will be affected by the U.S. sanctions due to changes [in policies],” the report said while listing other risks from Western nations not limited to the United States.

Expert: The CCP Fears Sanctions

A senior Chinese business finance columnist, Chen Siyu, told The Epoch Times that Western sanctions against Russia struck fear into the CCP. And that Beijing will incur massive technological and economic losses if its overseas assets are confiscated by the United States and other western countries. Thus, it is rapidly selling overseas assets and returning CNOOC to domestic IPOs.

Chen said the CCP has been stealing Western technologies through its “Thousand Talents Program (TTP)” and “Made in China 2025 Initiative (MIC 2025)” to cut corners in its R&D and overtake Western technological advancements.

TTP is a controversial state-backed recruitment plan criticized by U.S. officials for its role in transferring Western research and technology to China. MIC 2025 is an initiative announced by the CCP in 2015 to invest heavily in domestic technology development in order to end Chinese dependence on foreign technology, transforming China into a global powerhouse of high-tech industries in 10 years.

“The CCP has to rely on the United States [for its technologies and markets] whether it likes to or not. [It cautiously avoids direct conflict with the United States, fearing severe consequences.] On the one hand, it sends mixed signals on the Russia-Ukraine conflict, both withdrawing and providing support to Russia. On the other hand, it strengthens domestic food production [in fear of Western sanctions].”

“It’s about siding with right versus wrong; it’s about siding with the basic principles of the international system or for chaos and conflict. And ultimately, China has to choose,” Blinken said, placing further pressure on Beijing.

On April 12, the U.S. Securities and Exchange Commission (SEC) added 12 China Concepts Stock companies to a delisting watchlist, according to the Chinese edition of Voice of America. As of that day, there were reportedly 23 Chinese companies on that list, including Weibo, a Chinese social media giant.

Presently, more Chinese companies listed in the United States may follow in the footsteps of CNOOC.