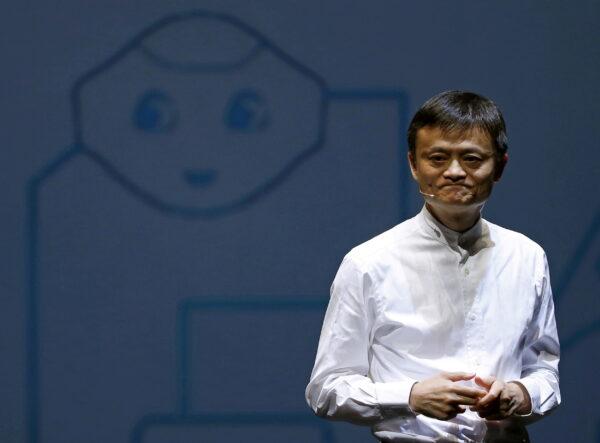

A reported comeback of Beijing-led regulatory crackdowns on Jack Ma’s Ant Group has sounded alarm bells for China’s fintech sector.

“The focus of the Chinese Communist Party is not on Jack Ma as a person, but the capital chain behind him,” said Taiwanese economist Wu Jialong.

“The central government has the intention of nationalizing its business as it wants to tighten its control over the financial sector,” he said, given that the payment provider, which is China’s biggest with over one billion users, had encroached on state-owned banks.

Yuan Hongbing, former head of the law school at Beijing University now a dissident living in Australia, called the move a “de facto yet disguised confiscation of wealth” from private enterprises in a bid to deal with the country’s now imminent economic crisis.

Rather than a matter of personal grudges between the business founder and Party leader Xi Jinping, the move against Ma has unveiled a power struggle between Xi and his political opponents, Yuan said during a Wednesday interview, given Ma’s acquaintance with Xi’s main rival ex-leader Jiang Zemin’s faction.

Beijing’s “very opaque” regulatory policy and “a high degree of uncertainty” in the financial sector further dims confidence in private investment, according to Wu.

The regime’s recent moves triggered a selloff in the technology sector on Tuesday.

Last month, China Cinda Asset Management Co. Ltd., one of the four biggest state-owned asset management companies in China, announced the scrapping of a planned Ant investment.

Cinda scrapped the deal to buy a 20 percent stake worth about $944 million in Ant Group’s consumer finance arm because of pressure from state authorities, people with knowledge of the matter have said.

Meanwhile, shares for China’s food delivery giant Meituan have continued to slide after state interference.

Shares in Tencent Holdings, which owns the Chinese social media app WeChat, have also tumbled this week, believed to be spurred on by a widely-circulated online post in China that suggested the tech and gaming giant could face another regulatory crackdown.

The post was later deleted and called out as a rumor by Tencent’s head.