The U.S. government updated its restrictions on chip exports to China in October. Specialized chips like Nvidia A800 and H800, which were previously exportable to China, are no longer permitted to be sold to the Chinese market. Additionally, even the less advanced deep ultraviolet (DUV) lithography equipment capable of producing chips in the 14 to 28-nanometer range has also been subjected to export prohibitions.

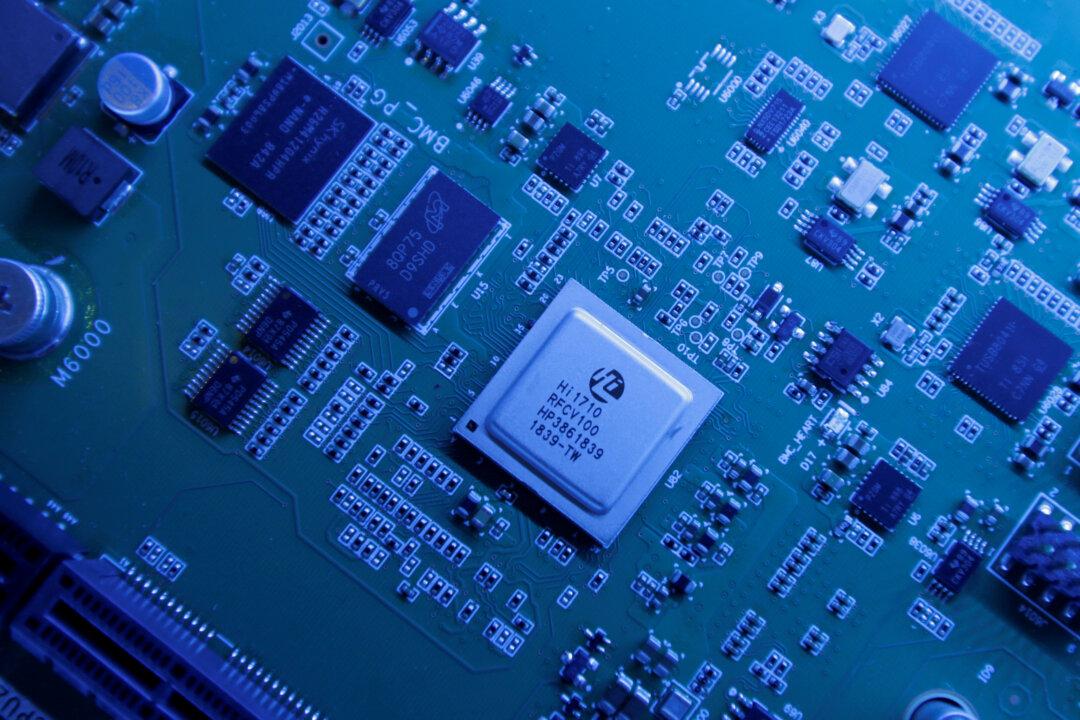

Semiconductors, a general term for chips, can be found in thousands of products, including smartphones, computers, and medical equipment. It is also an advanced and critical component of military electronic systems.