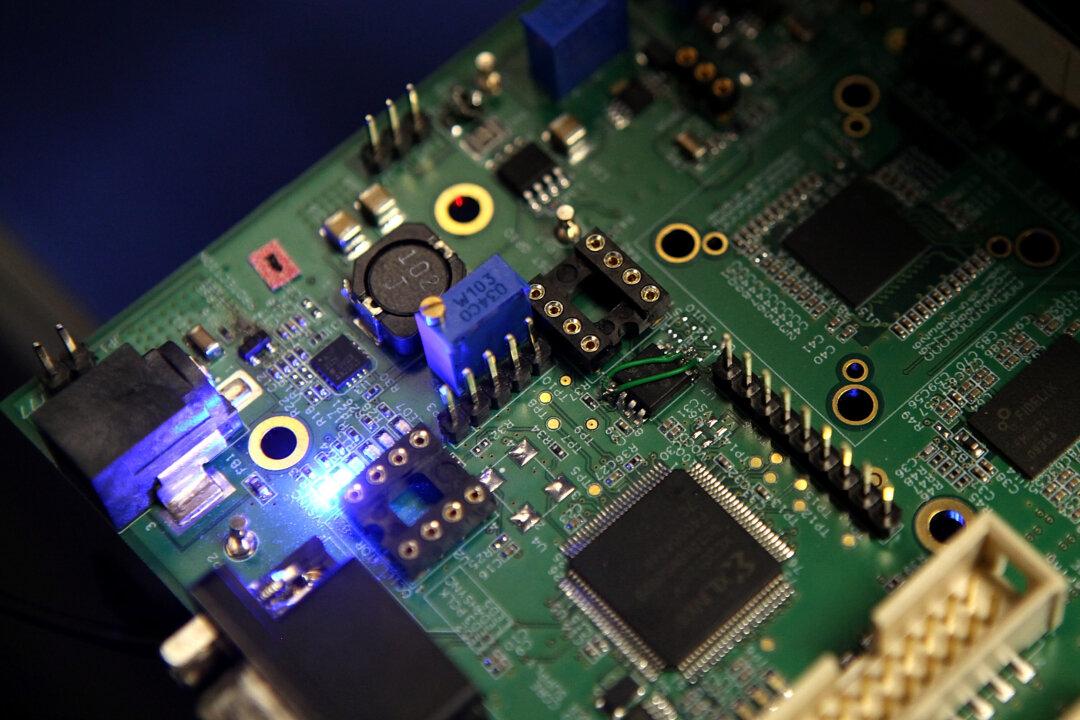

Both houses of Congress have tabled new legislation to boost domestic production and development of semiconductors, which are chips that power everything from smartphones, computers to missiles systems.

The move comes as the U.S. administration seeks to reduce its reliance on foreign supply chains, especially those in China.