Western Digital (WD), one of the world’s largest manufacturers of computer hard disk drives, confirmed that it suspended its partnership with Chinese tech giant Huawei and halted all shipments to China after U.S. authorities placed Huawei on a trade blacklist banning it from doing business with U.S. companies.

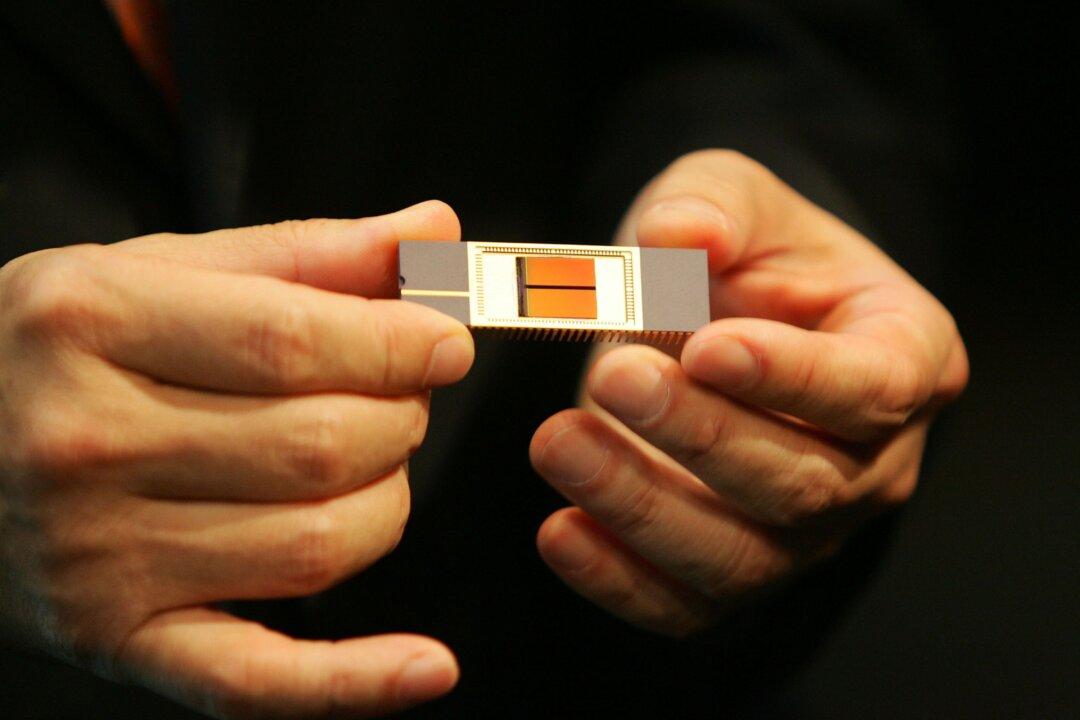

The California-based WD signed a strategic cooperation agreement with Huawei on March 28, in which it agreed to supply hard disk drives (HDD), solid-state drives (SSD), and NAND Flash continually to Huawei. HDD, SSD, and NAND Flash are data storage components broadly used in Huawei’s networking equipment, data center servers, telecom systems, equipment, smart phones, and other consumer products.