Commentary

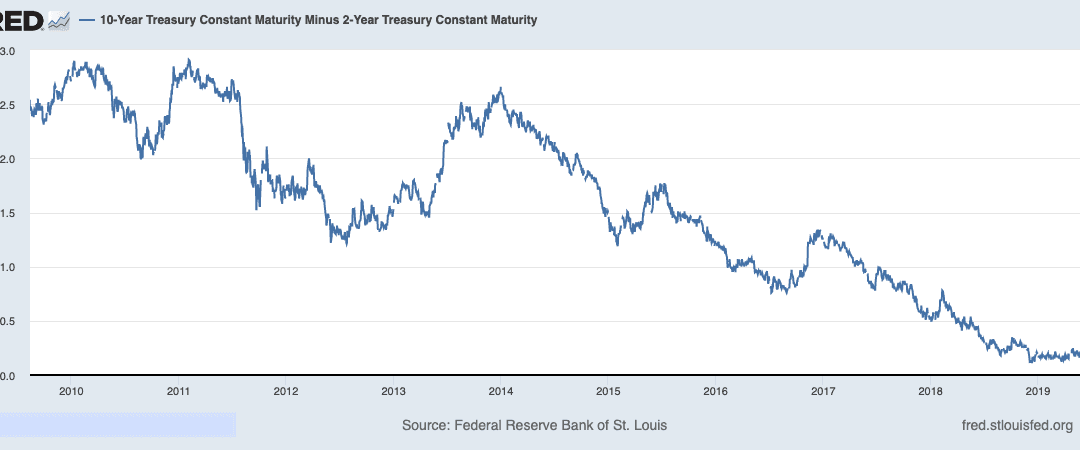

Since the U.S. yield curve inverted, predicting recession ahead, there have been voices again arguing “this time is different.” Like previous recessions, contrarians challenged the lack of theoretical basis behind it, others accused the yield curve slope as mainly governed by Fed policy which should be the true cause of boom-bust. In terms of reasoning, this time is no different. Having said that, they all got wrong practically even though their “theories” might be correct. Since data began, the curve predicted nine recessions, with only one turning out not happening.