Supermicro, one of the world’s largest makers of computer servers, has asked its suppliers to shift production out of China.

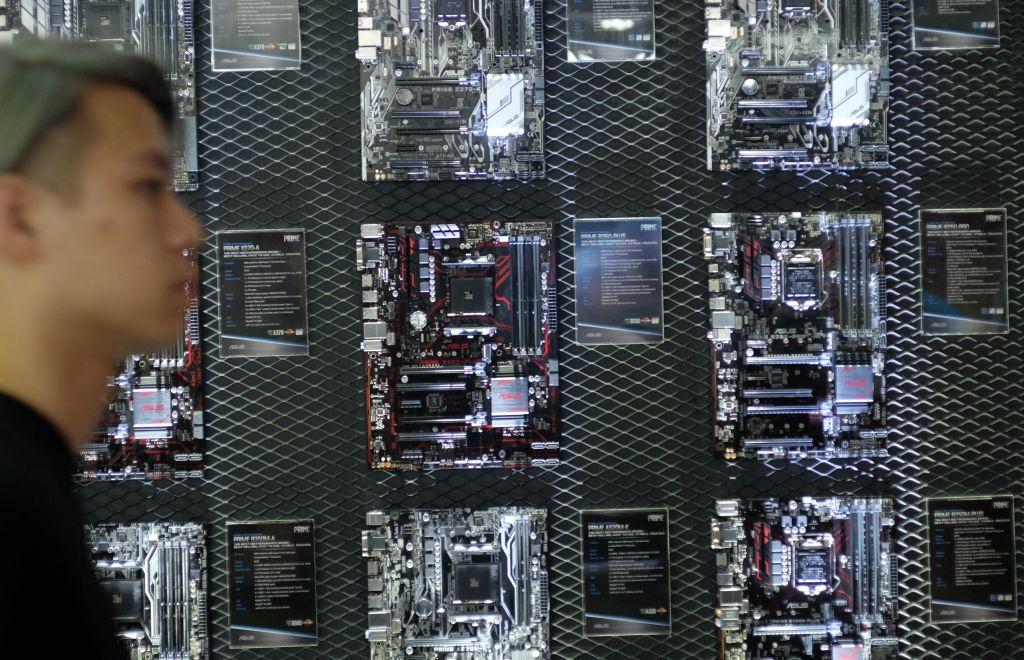

Security concerns surrounding the California-based tech company’s servers were sparked by an October 2018 Bloomberg report that claimed the Chinese military developed “spy chips” and had secretly planted them into motherboards manufactured in China and supplied to Supermicro.