BEIJING—Nearly a third of companies operating in China have seen their revenues slashed as the coronavirus outbreak disrupts activity, a survey by the American Chamber of Commerce (AmCham) in China showed on Feb. 27.

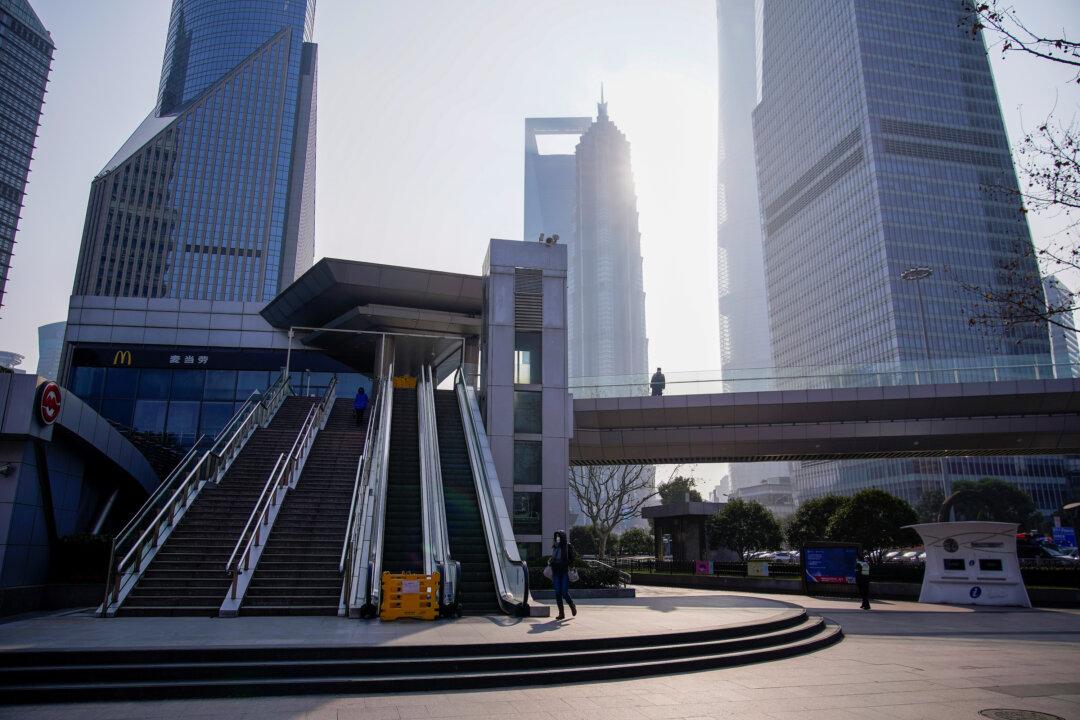

Travel restrictions and stringent quarantine rules implemented since January to minimize contagion risks in China have effectively paralyzed business activity.