A new survey shows more than two-thirds of Chinese bankers are not optimistic about China’s current macroeconomic climate.

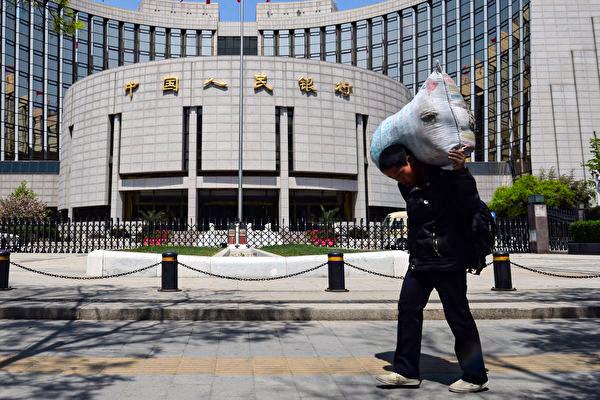

On June 29, the People’s Bank of China released its latest nationwide Banker Survey Report (pdf), showing various indices about the country’s macroeconomic climate, banking industry, loan demand, and monetary policy.