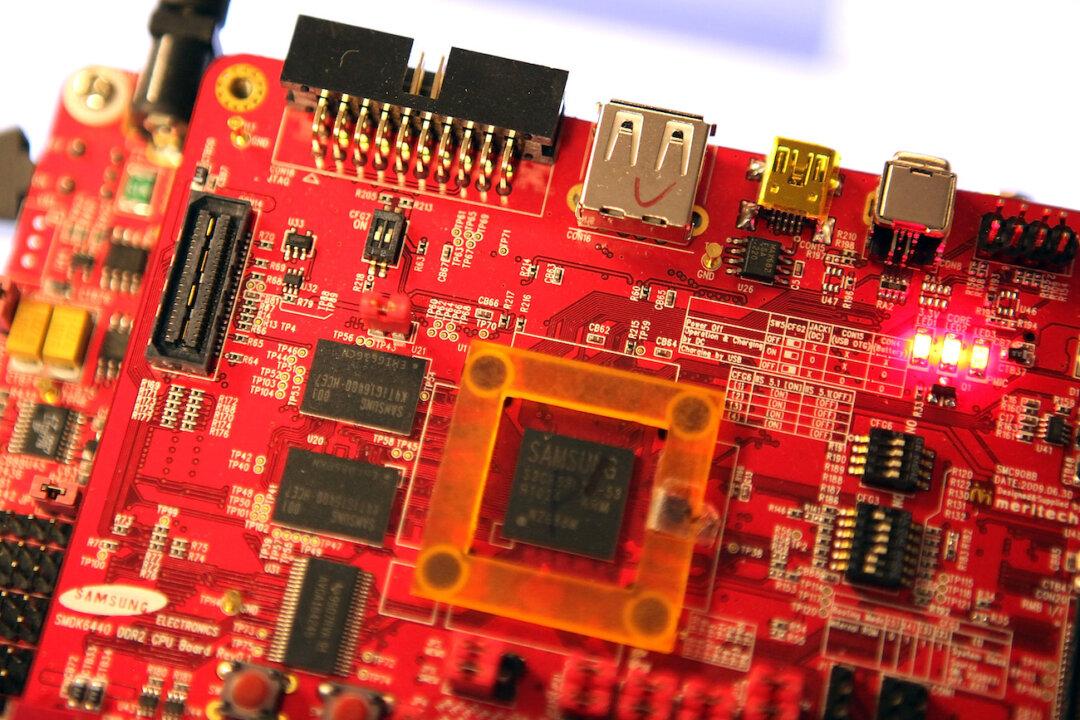

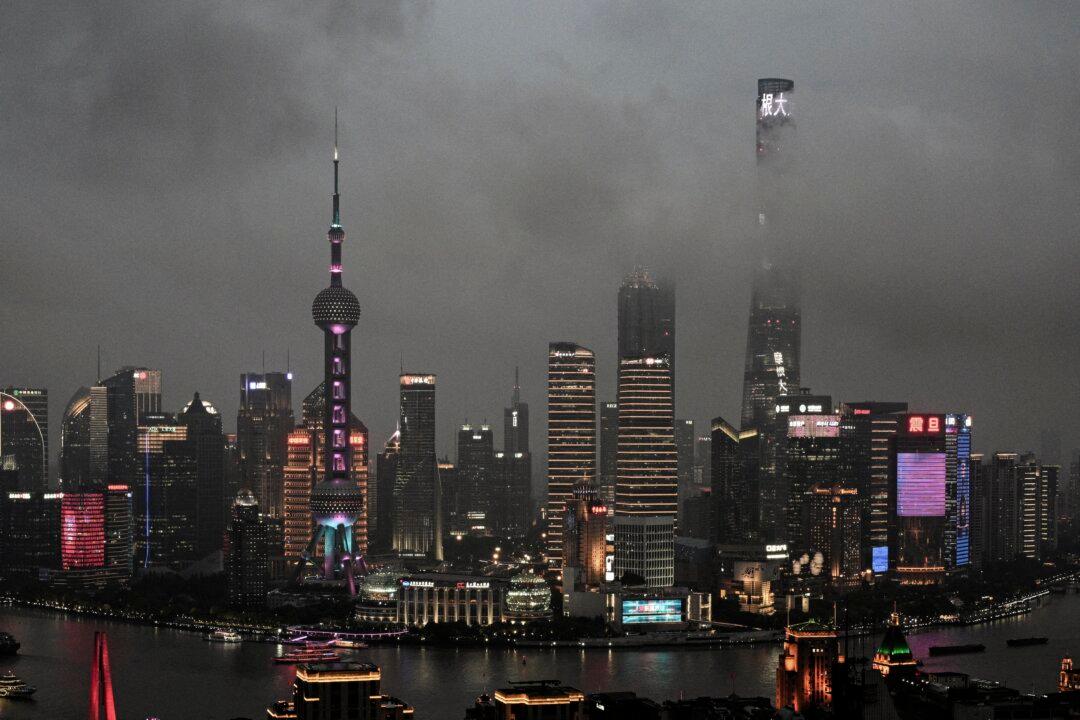

The House Select Committee on the Chinese Communist Party (CCP) has urged the Biden administration to take urgent actions targeting Chinese foundational semiconductors. This is to prevent the Chinese regime from dominating the semiconductor market.

“While the Administration has taken strong actions to ensure U.S. advanced semiconductor technology is not transferred to [China], far less attention has been given to the risk that a surge of China-made foundational chips poses to U.S. economic security,” the Committee said in a letter dated Jan. 5 to Secretary of Commerce Gina Raimondo and United States Trade Representative (USTR) Katherine Tai.